Pencils up? Tenney foresees M&A ‘spike’ in 2026

Key Highlights

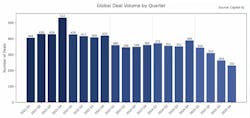

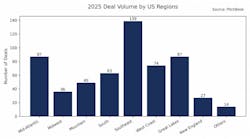

- Global M&A deals in transportation and logistics declined in 2025, reaching a five-year low amid tariffs, regulatory shifts, and freight recession.

- Specialized service providers like Service Transport Company and Texas TransEastern sustained their value as specialized operations, despite challenging conditions.

- Tariff policy volatility increased due diligence costs and delayed transactions, impacting seller outcomes and deal timelines.

- Market disruptions create opportunities, with experts predicting a deal activity spike in Q4 2026 as stability returns.

Dragged down by tariff uncertainty, regulatory shifts, and a prolonged freight recession, global mergers and acquisitions in the transportation and logistics (T&L) sector hit a five-year low in 2025, according to data presented by Tenney Group during the live webinar reveal of its 2026 M&A report. But discerning buyers stayed active, particularly in their pursuit of specialized services.

Two tank truck transporters fit the bill to a T.

Trimac Transportation’s strategic additions of heavy hauler Watt & Stewart and chemical carrier Service Transport Company, and Two Roads Partners’ investment in fuel transporter Texas TransEastern (TTE) were among a handful of last year’s transactions highlighted by Spencer Tenney, Tenney Group president and CEO, and Beau McGinnis, Tenney vice president, during a presentation sponsored by the Truckload Carriers Association as examples of deals that crossed the finish line amid challenging conditions that complicated valuation and execution.

“Folks are looking for opportunities and operations that can navigate some of these headwinds and … the nuance that exists when a market isn’t at its strongest,” McGinnis explained. “And so, when we look back at notable deals of 2025, there are several folks who are best-in-class performers and really specialize at what they do.

“Ultimately, that drove buyers to seek out these companies, because they knew that despite what was going on in the broader environment, they would be top performers who enhance their overall operations.”

The Jan. 13 webinar spotlighted the firm’s annual M&A report—which includes expert interviews with FTR Intel’s Avery Vise and Reliance Partners’ Thom Albrecht and insights on venture capital, technology, and artificial intelligence from Dynamo Ventures’ Santosh Sankar, ServiceUp’s Brett Carlson, and InMotion Global’s Tim Higham—and educational resources; and reviewed last year’s deal landscape, dispensed advice for prospective buyers and sellers, and delivered five predictions for 2026, including an impending spike in deal activity.

“Who knows what the Trump administration’s going to do next, but it appears that we’re moving in a more stable direction,” Spencer said. “Part of it is that people have had their backs against the wall, which will force the issue, and some of it is the environment getting more stable.

“But we’ll see the evidence of that through announcements in Q4—and then a ton of them into 2027.”

Specialized circumstances

The Trimac and TTE deals were among the 1,150 global T&A deals counted in the report, which also highlights Stonepeak’s partnership with Dupré Logistics and Kenan Advantage Group’s acquisition of Canadian milk hauler Fisher Transport. Trimac last year finalized the Watt & Stewart transaction in January and acquired Service Transport’s fleet of 300 trucks and 750 trailers in October; and New York-based private-equity firm Two Roads first invested in TTE in June 2025.

Tenney pointed to Trimac as an example of a “prolific acquirer”—the Service Transport transaction was Trimac’s 19th deal since 2019—that stayed active in the specialized space, strengthening its core competencies while also diversifying services through two opportunistic acquisitions. “You’ve seen Trimac slowly begin to diversify what they’re working on, and this move to expand in the United States, with the chemical work specifically, was interesting to me,” McGinnis said.

“It further cements that they’re trying to create a robust liquid bulk platform that can handle any type of work.”

Watt & Stewart was a high-performing, highly specialized flatbed fleet “completely insulated” from the struggles many fleets were facing, Spencer asserted, adding that specialized freight brokerages enjoyed similar advantages last year. But that deal was a better reflection of the environment many months earlier—before planning conditions began to deteriorate. “If you look back to the front half of 2025, that was where we had maximum disruption,” Spencer said. “And for a lot of folks, that was where conversations that should have gotten off the ground never launched. And we felt that pretty much throughout the whole year.”

Tenney advised on the Watt & Stewart and TTE transactions. Two Roads bucked expectations to invest in an asset-heavy transportation provider despite the prolonged freight recession due to the Texas-based fuel hauler’s “scale, tenure, and strong customer relationships” that supported its position as a “leading fuel-hauling platform” in the Gulf Coast, Tenney said. “In some cases, it’s much easier to identify what is a platformable investment or company in a market that has a lot of headwinds,” Spencer elaborated. “And in this situation, Texas TransEastern was the clear market leader. They had an extremely high-level and talented leadership team, a great management team, and they were growing against all odds.

“It was clear that this was something [Two Rivers] could build around.”

Environmental instability

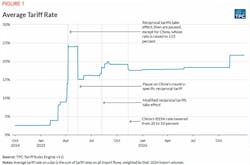

Still, transactions slumped from 1,468 deals in 2024—and 1,797 in 2021—in what Tenney characterized as a year of adjustment, rather than recovery, with deal activity declining five straight quarters after reaching 389 deals in Q4 2024. The firm cited a “prolonged” post-Covid-19 reset, overestimated “Trump bump” in economic activity, and market disruptions as contributing factors, but suggested the administration’s ever-shifting tariff policy was the most prohibitive element. “From an M&A perspective, we don’t need perfect conditions,” Spencer said.

“We just need stable conditions for a lot of deals to get done.”

Tariff-policy volatility made underwriting revenue, margins, and customer demand extremely difficult. These conditions resulted in a “pencils-down” approach across the industry, with several companies running out of time and filing for bankruptcy before a deal could be finalized, Tenney noted in its report. Tariff policy also expanded the required scope, time, and cost of due diligence, which, in turn, delayed and, in some cases, deterred deal activity. “For sellers that were either active or contemplating an exit, their outcomes were increasingly dependent on insulation from that trade-policy risk,” McGinnis said.

“I think that that’s still going to be true for a little bit in 2026.”

The M&A ‘spike’ is coming

However, market disruptions also create opportunities, and Tenney expects deal activity to ramp up later this year, and into 2027, with specialized companies remaining a prime target.

“Look for huge spike in Q4 M&A activity,” Spencer predicted. “And where we’re coming from on this is that it takes time to put these deals together. So first we need a stable environment, and then we need the natural time to go from idea to execution, which commonly takes eight to 12 months or longer, depending on the size and sophistication of the deal.”

Tenney made four other predictions in its 2026 M&A report:

- Policy-resilient transportation and logistics platforms will command premium valuations.

- Broad-based consolidation across supply chain technology will accelerate.

- Pure spot truckload businesses, undifferentiated freight brokerages, and standalone freight technology platforms without proprietary or defensible data are likely to repel consolidation.

- Cross-border and nearshoring logistics are the supply chain segments to watch.

“There are a lot of technology companies … all providing unique solutions. But the one thing that is scarce is the customer,” McGinnis said. “There are only so many customers out there who can afford to utilize this technology in its given state.”

Buying and selling in 2026

The webinar’s question-and-answer session provided advice for prospective buyers and sellers in 2026.

For owners assessing if now is the right time to sell, Spencer pointed toward Tenney University resources and outlined a process that includes identifying where you are, where you want to go, and the gap in between; considering time, capital, and risk appetite; building relationships and market awareness; and ensuring readiness for when opportunities arise. “Fifty percent of maximizing an exit is preparation,” Spencer said. “The other 50% is being in the right conversation at the right time with the right buyer.”

For prospective acquirers hoping 2026 is more productive, McGinnis recommended defining the problem you’re out to solve first, then evaluating the most meaningful factors, including personnel risk, concentration risk among customers, and any deal-breakers. “What you don’t want is to get into a situation where you have this red line you should have drawn, and then you’re six months in, you’ve spent a lot of money, and you finally decide that red line is firm.

“Have a good foundation for the things that matter to you most, so you understand what those are earlier than later—and save everyone’s time and money.”

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.