Inflation, interest rate hikes, and the declining freight market conspired to curtail mergers and acquisitions in the transportation and logistics (T&L) space in 2023, with transactions and transaction values both down year-over-year, according to a new M&A report from advisory firm The Tenney Group released Monday.

But Trimac Transportation was undeterred, executing four transactions worth nearly $90 million combined amid trying times.

“That difficulty in the market was absolutely real, but we found that if we’re committed to being creative, cooperative, and flexible, we can get deals done—because there were fewer buyers there as well,” Dan Carpenter, Trimac vice president of finance and business development, explained in a special edition of The Hot Seat with Spencer Tenney, Tenney Group CEO, aired in conjunction with the company’s 2024 annual report.

Niche players like Trimac, who expertly structured acquisition deals, still rode the valuation “rollercoaster” to new highs in 2023. But Tenney expects more buyers and sellers to enter the M&A fray this year, generating more opportunities for everyone to participate, thanks to a “recovering” freight market, “normalized” equipment values, and potential interest rate reductions all combining to encourage consensus.

See also: Trimac executes fourth acquisition of 2023

“We feel very strongly that 2024 is going to create a lot of opportunities because sellers have been conditioned to get back to where they need to be, and the pain points in the market, as far as the increasing costs, have created a certain level of urgency for buyers to come to the table in a very fair-minded and effective way to get something done, and they have more competition,” Spencer said in a Jan. 18 webinar produced in assocation with the Truckload Carriers Association.

“We’ve never had more competition as far as new buyers entering the space, so we think there will be more buyers and more sellers—and, as a result of that, we’ll go to the point of valuation alignment much easier.”

Carpenter concurred, saying M&A activity already is spiking in the bulk sector.

“We have a number of LOIs [letters of intent] and exclusivity processes we’re already involved in,” he maintained. “I expect to meet last year’s output by the end of the first quarter. We have a lot of pent-up opportunities. In fact, we probably have more deals than we have capital to spend, [or] room on the balance sheet.”

Short supply of sellers

The total transaction value of last year’s deals was 82% lower than in 2022, Spencer said, citing data from market intelligence platform Capital IQ; and total transaction activity was down 33% year-over-year. Carpenter attributed the decline to an expectations gap after a “record year” for many trucking companies in 2022. Still buyers and sellers came together for several notable deals, including Trimac’s acquisition of Doyle Sims & Sons Trucking, and Dupré Logistics’ pickup of Interstate Transport, both facilitated by Tenney.

Spencer and Meg Meurer, Tenney chief commercial officer, also highlighted Schneider’s purchase of M&M Transport, which grew Schneider’s dedicated business to 6,500 power units and $1.5 billion in revenue; private-equity firm Trident’s investment in Priority Courier Experts in a “nine-figure” deal on the asset-light side; and Forward Air’s newly amended merger with Omni Logistics that ends their litigation.

“In our space it was probably more about the deals that didn’t happen,” Carpenter said. “There were a lot of platforms—Quantix, Quality Carriers, KAG [Kenan Advantage Group], Heniff [Transportation Systems]—who’ve been rumored to be ripe for private equity to let them go, or resell them into the market, and that didn’t happen.

“TFI continued to be quite active, with their Daseke acquisition and several others they did. So they’re … a role model of ours, but [there wasn’t] a lot going on in the bulk space, which was a surprise and for us a benefit because there weren’t as many buyers, and [we had] an opportunity to pick up some good companies.” Trimac’s other 2023 acquisitions included Jacknife Oilfield Services, Transport Sylvain Lasalle, and AIP Logistics.

Many T&L business owners who wanted to exit last year either never began or paused during the process, Tenney reported, instead closing their doors “suddenly,” declaring bankruptcy, or opting to wait until the market normalizes, resulting in the dearth of M&A activity, particularly among small to mid-sized fleets—contrary to Tenney’s 2023 prediction.

“I’ve never seen anything like this,” Spencer said of the short supply of sellers.

‘Pent-up’ deal demand

The industry’s in for another novel experience in 2024, he added.

The supply of T&L companies available for purchase is at a “10-year high,” Tenney contended in its annual outlook, with the “pent-up supply” fueled by adverse selling conditions over the last four years creating the opportunity for “a few extraordinary deal announcements in 2024.”

“We’re still going to see a very aggressive type of approach toward acquisition, but a much more disciplined application of where the money goes and why,” Spencer predicted. “So you’re going to see these companies … [making] investments that are highly defensible to their shareholders when it comes to strategic fit.

“For those who haven’t gotten in the acquisition game, this is the time to make a move—and we’re excited for it.”

Frustration motivates many sellers, Spencer said. Others are fatigued—or see the headwinds only growing stronger in the future. “There are a lot of people, especially the family-run businesses that are a little bit smaller, who are tired,” Carpenter asserted. “It’s been a grind for the last three or four years, going through Covid, but also tort reform and insurance premiums going up—it’s a slog.

See also: Dupré expands temperature-controlled solutions

“The industry needs consolidation. A lot of people who’ve built up their own companies are tired … and many of them don’t have family members who they can give the business to. So if you can … project a family-run attitude, where you’re going to carry on their legacy and continue to invest in what they’ve built and allow them to maintain that pride, you’re going to find opportunities.”

Strategic acquirers fuel activity

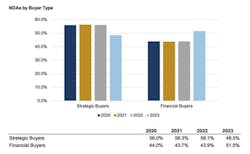

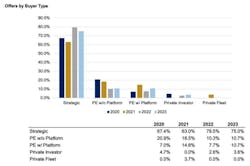

Over the last nine months, Tenney logged “record interest” from new strategic acquirers—like the family-run businesses Trimac targets—who also are more likely to make qualified offers than financial investors, Spencer asserted.

“Over the last four years, no matter what the freight market is [or] what’s going on with interest rates, the folks who continue to understand the cyclicality of this space, the asset-heavy nature of this space, the opportunities, [and] how to win, continue to be people who already have an existing investment interest in this industry,” he said.

“So the takeaway … is, as a seller—[and] we’re all going to get out of this industry at some point, by choice or by force—it’s very likely that someone who’s going to invest in your business is someone who already understands this space.”

Carpenter traced Trimac’s success in the M&A space to its 2019 deal with Gibson Energy that doubled its size in Western Canada, and renewed leadership’s interest in acquisitional growth, either by pursuing profitable companies with strong operating ratios and management teams, or adding complementary businesses, like third-party logistics, equipment leasing, transloading, and warehousing.

“When we find companies that want to sell, retire, and move on, we’re not really interested,” Carpenter said. “When it comes with talent—maybe it’s young talent that wants to stick around, wants to continue to build and just doesn’t know how, or doesn’t have the wherewithal, the balance sheet, or the capital capabilities—we like to embrace those folks. And, in fact, we’ve hired a couple of the presidents of those companies into the M&A team because they have such good connections with their peers in industry associations and can put the word out about their experience, how the process went, [and] what to expect.”

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.