NTTC examines petroleum driver shortage

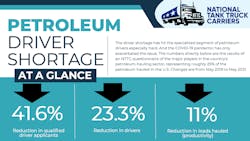

National Tank Truck Carriers recently highlighted how the driver shortage is impacting the petroleum-hauling segment, saying the shortage has hit the specialized segment especially hard, and the COVID-19 pandemic only exacerbated the issue.

According to NTTC, there was a 41.6% reduction in qualified applicants for petroleum-hauling assignments from May 2019 to May 2021, along with a 23.3% reduction in drivers, and 11% reduction in loads hauled, which indicates the segment’s productivity. The statistics were gleaned from a questionnaire the association sent to key players in the sector who represent roughly 25% of petroleum hauled in the U.S.

Hires per job postings

From September 2016 to January 2021, petroleum carriers and other heavy tractor-trailer drivers have seen an average of one hire for every nine job postings, NTTC said. During the same period, the blue-collar workforce—a broad pool that covers workers with a high school diploma or less—has seen one hire for every one job posting. This further highlights the difficulty petroleum carriers have finding qualified professional drivers to fill increasing demand.

The association called the issue “a problem unique to trucking.”

Aging workforce

Truck drivers are much older than the workforce at large. Eighty percent are over 45, and 23% are over 55. Without an influx of young drivers, NTTC said, the shortage will only grow more rapidly.

Pandemic effect

The effects of the pandemic and accompanying response have been massive. For petroleum carriers, and the trucking industry at large, it has only served to escalate an already growing driver shortage. DMV and driving school closures as part of the pandemic response created a void of new drivers entering the workforce.

Trucking overall saw a 38% decrease in job postings in 2020. Because of lockdowns and travel restrictions, the petroleum-hauling sector was uniquely hard hit, NTTC said. The subsequent decrease in fuel consumption led many drivers close to retirement age to retire early, while others were furloughed due to a lack of work. This has dramatically exacerbated the driver shortage issue as economic conditions have quickly recovered in 2021.

Barriers to entry

NTTC pointed to several barriers to entry it says are unique petroleum and hazmat trucking companies, including images issues; certifications; employment-based, third-preference visas; age requirements; and FMCSA’s Drug & Alcohol Clearinghouse.

- Image issue: Lifestyle of truck drivers still marred in the eyes of the general public

- Certifications: Hazmat, TWIC (same info to two agencies), training required at each loading facility

- EB-3 visas: Needs fast-tracking for hiring experienced immigrant drivers

- Age requirements: Must be 21 for interstate CDL, 23 to deliver hazmat

- D&A Clearinghouse: As of April 1, more than 50,000 drivers in prohibited status with at least one violation

Colonial Pipeline shutdown

The Colonial Pipeline shut down for five days (May 7-12) due to a ransomware attack. This caused fuel shortages, panic buying, and price spikes that highlighted weaknesses in the petroleum supply chain, NTTC said. The U.S. is one natural or man-made disaster away from collapse. A lack of petroleum drivers plays a significant role in these weaknesses.

Contact NTTC at [email protected] or visit tanktruck.org for further information.