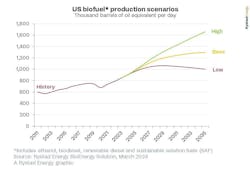

United States biofuel production will increase by 53% over the next 10 years to meet growing demand for renewable diesel and sustainable aviation fuels (SAFs), according to a new report from business intelligence firm Rystad Energy.

The surge will send U.S. production to 1.3 million barrels of oil equivalent per day (boepd) by 2035, the firm predicted.

The expanding role of biofuels is due to government and industry efforts to decarbonize the transportation sector, Rystad reported, with plant-based alternatives to traditional fuels playing a “fundamental” role in limiting emissions from road vehicles, shipping, and aviation. For instance, SAFs are “almost identical” to conventional jet fuel but are produced using feedstocks like fats, oils, and agricultural and municipal waste, providing the potential to “significantly reduce” emissions in the aviation industry.

“Biofuels look likely to play a crucial role in the future low-carbon energy world, and the U.S. is uniquely positioned to capitalize,” Artem Abramov, Rystad head of clean tech research, said in a news release. “The market's momentum has gathered in recent years, and its growth is assured through the end of this decade, but some uncertainty remains into the 2030s.”

Domestic output is expected to surpass 1 million boepd as early as 2026, Rystad added.

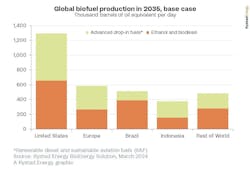

Looking ahead to 2035, the U.S. is expected to dominate production of both ethanol and diesel, as well as advanced biofuels. The U.S. will produce 40% of the total global output by 2035, and of that 1.3 million boepd, advanced fuels will account for about 50% of domestic production, the company said. Europe and Brazil will be the next biggest producers, but significantly behind the U.S. Europe is expected to produce about 580,000 boepd in 2035, while Brazil’s output will reach 510,000 boepd.

“Our production forecast uses our base case expectations for technology advancements, electric vehicle (EV) adoption, and the availability of biofuel feedstock and assumes existing policy support remains in place,” Rystad stated.

The firm also mapped out two other scenarios, a “high case” and a “low case.”

- High case: Rapid technological advances, slower EV adoption, favorable biofuels policy, and ample feedstock availability.

- Low case: Slower technological development, faster EV adoption, biofuel policy support reversed, and feedstock supply challenges.

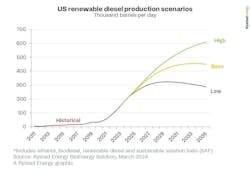

Advanced biofuels such as renewable diesel and SAFs are the key swing factors impacting the market’s future, Rystad said. “Renewable diesel production has snowballed in recent years, increasing from 25,000 barrels per day (bpd) in 2020 to an expected 220,000 bpd this year. Consumption in the U.S. topped 200,000 bpd during some months in 2023, and this growth story looks set to continue for some time. In all three scenarios, Rystad expects renewable diesel production to grow significantly until 2030.

One of the biggest hurdles to strong renewable diesel growth is feedstock availability, primarily soybeans. Early production capacity expansion has been driven by the same first-generation vegetable oil feedstocks, which are used by biodiesel producers and the food production industry. For example, consumption of soybean oil for biofuel production doubled from about 600 million pounds per month in 2017-2019 to a staggering 1.1 to 1.3 billion pounds in the second half of 2023. Rystad estimates that 2024 will be the first year in U.S. history when biofuel production will account for more than 50% of all soybean oil consumption in the country. Competition for canola and corn oil is also growing, and relying on these first-generation feedstocks could severely limit the market’s growth potential.

Click here to read more from Rystad’s report on biofuel demand.