Bulk fleets explore all their equipment options

For-hire carrier and private fleets in the bulk space are searching for solutions to their ongoing supply-chain dilemmas.

In many cases, that means seeking out new equipment sources.

Other companies are stocking up on inventory by buying anything and everything available, shopping around to multiple dealers, distributors, and online vendors—or simply parking trucks, throwing up their hands, and waiting for backordered parts to make it to their shops.

As one respondent replied, they’re “exploring any and all options”—including junkyards.

That’s one of the key takeaways from Bulk Transporter’s 2022 Parts Purchasing Survey of 68 stakeholders representing companies across the entire bulk transportation sector, including for-hire carriers, private fleets, petroleum jobbers, retail fuel dealers, tank depot operators, and leasing companies, conducted between Feb. 22 and March 23. Respondents primarily were in executive management (43%), with operations managers checking in second (25%).

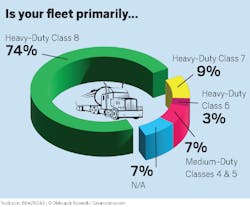

Of the representatives surveyed, 34% ran 11-50 trucks, 24% operated between 51 and 500 trucks, and 10% deployed anywhere from 501 to 1,000-plus vehicles—and, unsurprisingly for the sector, 74% of the time their primary vehicles were Class 8 tractors.

While a handful of respondents said they hadn’t adjusted sourcing to keep fleets running, most indicated they were turning to multiple new suppliers in search of new and used parts and equipment, as evidenced by the variety of parts sources selected. Truck and trailer dealerships were the primary parts source for most fleets (49%), but when asked separately to select all sources they use, 79% said they go to dealers, 63% also use local independent distributors, 59% hit up tank truck industry-specific equipment distributors, and 31% buy from online commercial vehicle parts suppliers.

Other sources included independent repair garages and contract maintenance providers (35%), and automotive parts store chains (29%).

The following are highlights from the 2022 Parts Purchasing Survey. Check out the media gallery for expanded results that did not appear in the May/June print edition of the magazine.

Universal utility

Bulk Transporter asked participants about their purchase plans in 32 product categories.

“Fittings, camlocks, and couplers” and “brakes and brake parts” checked in second, with 78% of respondents anticipating a purchase in those categories within the next 12 months. Other popular categories included “wheels, wheel ends, and tires,” with 74% anticipating a purchase within 12 months; “decals, placards, and ID products” (71%); “chassis and suspensions” (65%); “pumps and compressors” (63%); and “vehicle lighting and wiring harnesses” (61%).

Also, despite soaring vehicle prices and OEM backlogs, 76% of respondents indicated they plan to purchase a truck or tractor within the next 12 months, with 36% eyeing a one-to-three-month window, 19% looking at four to six months out, and 21% anticipating seven to 12 months. Twenty-four percent of respondents reported annual truck budgets in excess of $500,000, and 18% spend between $250,001 and $500,000.

Urgent demand

As expected, frequently replaced items like brakes and tires topped the list of urgently needed products.

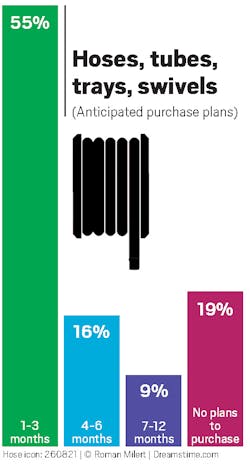

Fifty-seven percent of respondents anticipated making a brake or brake parts purchase within the next three months; and 52% predicted a wheel, wheel end, or tire purchase in the same period. Other hot items included hoses, with 55% anticipating a purchase in one to three months, fittings (55%), and decals (46%).

Backburner buys

Among the products that weren’t in respondents’ immediate purchasing plans were longer-lasting items like dry bulk trailers, IBCs, and other specialized bulk trailers—like LPG and cryogenic trailers—with more than 70% indicating they didn’t anticipate a purchase within the next 12 months in each of those categories.

Other products fleets are holding off on include cross-drop and overfill prevention systems, and transportation management systems.

Of note, though dry bulk trailers weren’t in most participants’ immediate plans, liquid tank trailers were, with 54% saying they anticipate making a liquid tank purchase in the next 12 months. Twenty-two percent expected to add tank trailers in one to three months, and 19% were looking at buying in seven to 12 months.

Select responses

When asked where else parts are purchased, respondents also said government sources, direct from OEMs, and leasing companies.

- “We began stocking up about seven months ago on DEF, tires, brake drums and pads, and certain engine environmental parts.”

- “Getting parts wherever I can. Cost no longer is the driving factor.”

- “We’ve increased online parts purchases.”

- “Researching and purchasing alternate parts that fit.”

- “Parts are backordered, so we sometimes need to park a truck until it can be repaired.”

- “Waiting and begging.”

Supply chain disruptions and OEM backlogs affected purchasing plans in a variety of ways, including:

- “I’ve had trouble finding 24.5” tires.”

- “It’s hard to get replacement parts to maintain vehicles.”

- “Costs have increased dramatically.”

- “We’re ordering a year ahead of time, not knowing if equipment will be needed when it arrives.”

- “We’ve pushed back items that we wanted to update.”

- “We are stocking more new parts than we ever have had to—probably doubled our inventory.”

- “We need specialized hazmat trailers, which now have a lead time of 12 months. We’ve expanded the number of dealers we work with in order to better source equipment.”

- “We use independent contractors. We are averaging, in a small fleet, 1-2 trucks waiting 2-3 months for computers, and paying twice as much.”

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.