AGC: Nonresidential construction materials costs accelerate in June

Key Highlights

- The producer price index for construction materials increased 0.2% in June and 2.3% year-over-year, the largest rise since February 2023.

- Tariffs on steel and aluminum were increased to 50%, with potential for even higher tariffs on imports, raising concerns about escalating construction costs.

- Key inputs such as aluminum, steel, and lumber saw significant price jumps, with steel mill products rising over 5% and some steel types increasing by more than 20%.

- Rising costs and economic uncertainty are causing some project delays, with industry leaders warning that further tariff hikes could worsen the situation.

- While tax incentives and regulatory reforms aim to boost the industry, rising material prices threaten to offset these benefits and slow growth.

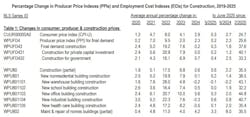

The producer price index for materials and services used in nonresidential construction rose 0.2% in June and 2.3% from June 2024, the largest 12-month increase since February 2023, according to a recent analysis of government data by the Associated General Contractors of America.

Association officials cautioned that tariff increases due to take effect in August threaten to drive up a wide range of construction costs that could further undermine demand for construction.

“The fact that construction materials prices are rising even before the steepest proposed tariffs have taken effect doesn’t bode well for what will happen in August if the promised new tariffs are implemented,” Ken Simonson, the association’s chief economist, said in a news release.

“Rising construction costs and economic uncertainty are already causing some owners to put projects on hold, which will only get worse if costs jump again.”

Simonson noted that tariffs on steel and aluminum were hiked to 50% on June 4 from the 25% rate that took effect on March 12. In addition, the president threatened to impose much higher tariffs on most imports from almost all of the nations that supply vital construction materials.

Three major construction inputs contributed to the acceleration in year-over-year costs. The producer price index for aluminum mill shapes climbed 6.3% from June 2024 to last month, while the index for steel mill products rose 5.1% and the index for lumber and wood products increased 4.8%. Simonson noted there were much more extreme increases for certain types of steel used in construction, such as 22.5% for fabricated structural metal for bridges and 8.3% for bar joists and rebar.

Association officials said the impacts of new tariffs have the potential to undermine some of the benefits for the industry that came out of the One Big Beautiful Bill Act. That measure provided tax certainty and financial incentives for firms to modernize equipment and invest in innovative new procedures. But those benefits could be outweighed if rising materials costs prompt more developers to delay or cancel planned projects.

“The construction industry is poised to benefit from greater tax certainty as well as the administration’s efforts to streamline permitting and reduce needless regulatory burdens,” AGC CEO Jeffrey Shoaf said. “Finding a way to provide greater certainty on materials prices is the best way to make sure the new tax and regulatory approach have the best possible impact on economic activity.”