The dedicated contract carriage segment of the national liquid and dry bulk truckload market is expected to outpace U.S. gross domestic product (GDP) growth through 2029 due to nearshoring trends driving demand for industrial gases, and sluggish electric-vehicle adoption buoying gasoline demand, according to a new market study from Logistics Capital and Strategy.

The Arlington, Virginia-based advisory firm also forecasts the U.S. South Central bulk market to outperform the national market due to high regional population growth—about three times the national average—gasoline and diesel consumption increases attributed to above-average internal combustion engine usage, and surging transborder trade with Mexico.

The findings are part of the firm’s May 2025 study of gasoline, specialty chemical, and hazardous materials distribution, which includes input from Bulk Transporter and two dozen other industry stakeholders. The company estimates the total national bulk truckload transportation market was worth about $48 billion in 2024. Approximately $12 billion of the total bulk market was dedicated, with the other 75% consisting of for-hire carrier and private-fleet tank truck transportation.

“The purpose of the study was to evaluate the national hazardous materials tank truckload market and specifically look at growth in terms of the split between dedicated for-hire and private fleets,” said Duval Adair, Logistics Capital engagement manager. “And through the course of the study we found some counterintuitive growth vectors. In the past couple of years there’s been a lot of discussion of ESG, but we think a lot of the structural factors, such as EV growth being slower than a lot of people anticipated, has created an above-GDP growth outlook for the market, specifically in places like the U.S. South Central.”

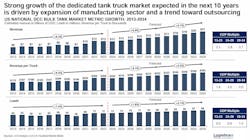

For 2024-2029, Logistics Capital expects tank truck volumes to experience a “gradual annual growth” at a 0.9x GDP multiple, prices to grow at 2.0x national GDP, and revenues to soar at a 6% compound annual growth rate (about 2.8x GDP). Trends supporting growth include increasing volumes in gasoline deliveries, bulk food products, chemicals and industrial gases, and plastic resin exports.

Diving deeper, the firm says U.S. South Central gasoline usage will outgrow the rest of the U.S. and continue to resist widespread EV adoption; population growth will boost demand for bulk food trucking, and a growing propensity for coffee consumption will further provide a structural tailwind; the return of U.S. manufacturing and nearshoring trends will drive demand for industrial gases; and the plastic resin market will enjoy rapid growth as exporters diversify to new destinations, and the U.S. fuel cost advantages continues to support the market.

“There also are a lot of structural factors for non-gasoline markets, such as plastic resins or industrial chemicals,” Adair added. “And given some of the nearshoring trends, there’s been increasing focus on trying to improve the industrial manufacturing base, so we think those will provide strong growth winds for the market going forward.”

Other findings of note include:

- Some industrial transportation equipment will continue to rely on diesel fuel due to power constraints and performance needs.

- Hydrogen-powered vehicles are another potential threat to fuel distribution but are further behind electric vehicles due to technological challenges.

- Despite a decline in consumption, the U.S. has become the world’s largest producer of crude oil—creating demand for energy transportation.

- Tariff have caused import surges, and will likely create sharp volume decline in May and part of June but recovery could begin as early as July.

- Strong growth of the dedicated tank truck market expected in the next 10 years is driven by expansion in the manufacturing sector and a trend toward outsourcing.

- In the gasoline and diesel segments of the market, dedicated contract carriage is expected to take share from private fleets over the next decade.

Contact Adair at [email protected] for more information.

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.