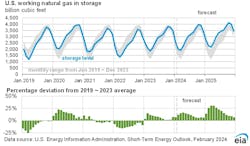

The U.S. Energy Information Administration (EIA) estimates U.S. natural gas consumption reached a record high in January at 118 billion cubic feet per day (Bcf/d). A burst of cold weather increased demand for heating and reduced natural gas production, leading to high inventory withdrawals, according to the agency’s February Short-Term Energy Outlook (STEO).

EIA now expects natural gas inventories to remain above their previous five-year average, despite the high withdrawals in January. EIA also expects about 15% higher U.S. natural gas inventories at the end of this winter compared with the previous five-year average because of forecast milder weather, the agency added.

EIA forecasts U.S. natural gas production to increase in February, reach 105 Bcf/d in March, and stay close to that level for the rest of 2024. As a result, EIA expects prices to fall from January’s average of $3.18 per million British thermal units (MMBtu) to about $2.40/MMBtu in February and March.

“The cold weather last month sent us into record-setting natural gas consumption territory for a few days, but we expect less-than-average consumption going into February and March,” Joe DeCarolis, EIA administrator, said in a news release. “Any late-winter cold snaps could introduce significant volatility back into the natural gas market.”

Other highlights from the February STEO include:

- Natural gas. The electric power sector hit record-high natural gas consumption in January, and EIA forecasts that it will increase 5% in the first quarter of 2024 compared with the first quarter of 2023.

- Power sector. EIA expects the U.S. electric power sector to generate 43% more electricity from solar in 2024 than in 2023. EIA forecasts wind generation to grow by 6%. Capacity additions support this strong growth in renewable generation in 2024.

- Coal markets. Due to planned coal-fired plant retirements, EIA expects domestic coal consumption to fall over the next two years, resulting in 19% lower U.S. coal production in 2024 and another 3% lower in 2025.

- Crude oil. EIA estimates that U.S. crude oil production set a record high of about 13.3 million barrels per day in December. Production is expected to nearly return to those highs in February before decreasing slightly through the middle of 2024.

- Global oil prices. The Brent crude oil spot price increased in January to average $80 per barrel. This increase is the result of heightened uncertainty about global oil shipments due to increased attacks on vessels in the Red Sea shipping channel. EIA forecasts the Brent crude oil price to average $81 per barrel in December 2024 and fall to $78 per barrel in December 2025.