AGC: Falling energy costs offset hikes in asphalt, steel prices in March

The price of materials and services used in nonresidential construction inched down 0.1% from February to March, as plunging fuel prices outweighed increases in the cost of other goods, according to a recent analysis of government data by the Associated General Contractors of America.

Association officials said new rules associated with federal funding for a range of infrastructure projects will make it hard for firms to procure materials and may drive bidders away from the projects.

“With materials costs fluctuating so much month-to-month, contractors remain wary about committing to projects with unpredictable costs and lead times,” Ken Simonson, AGC’s chief economist, said in a news release. “While inflation in the broader economy is settling back to earth, construction costs keep hitting updrafts.”

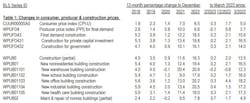

The producer price index for inputs to nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—ticked down 0.1% from February to March. The downturn was driven by a 2.3% drop in energy inputs, while the index for goods other than energy and foods climbed 0.5%. The index for services declined 1.0%.

Price patterns for key construction inputs varied widely in March. Price changes for the month ranged from increases of 2.1% for liquid asphalt and 1.2% for steel mill products to a decrease of 7% for diesel fuel.

Despite the recent moderation, many inputs continued to post double-digit cost increases from a year ago. Prices jumped 17% year-over-year for cement, 14.5% for both concrete products and architectural coatings, and 14.1% for paving mixtures and blocks. Prices climbed by 11.8% for gypsum building products and for construction machinery and equipment, 10.6% for flat glass, and 10.5% for insulation materials.

Association officials said firms are struggling to source materials that comply with strict new Buy America Build America requirements. The new rules governing procurement for many federally funded infrastructure projects require products to not only be manufactured in the U.S., but from components that were sourced with raw materials mined in the U.S. Few materials, including even screws, meet the new requirements, making it hard for firms to estimate construction costs and scaring some away from bidding for fear of running afoul of the new requirements.

“At some point people are going to wonder why all these projects the administration has announced funding for aren’t moving forward,” said Stephen E. Sandherr, the association’s CEO. “Many projects will have a hard time getting bidders who can find materials that comply with these unworkable new requirements.”