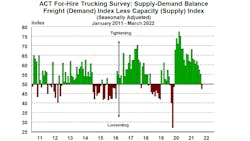

The balance of freight supply and demand is turning against for-hire trucking fleets for the first time since early in the COVID-19 pandemic, according to the most recent Freight Forecast report from ACT Research.

“As recently as the start of the year, pricing power in the truckload market was firmly with fleets,” said Tim Denoyer, ACT’s vice president and senior analyst. “But once a pendulum gets going, it’s very hard to stop. Not coincidentally, the Supply-Demand Balance in our For-Hire Survey turned loose (in March), for the first time since June 2020, as the rebalancing, drawn-out by the pandemic, hit critical mass.

“We’ve received many questions lately about the freight sector’s leading role in the economy. While we agree it is a leading indicator, it’s mainly for the goods economy, rather than the larger service sector. We also agree that Russia’s war has a tough-to-quantify but clearly adverse macro impact, and softer freight volumes are consistent with a slower economy.

“The driver shortage is over. The record drop in spot rates ex-fuel in the past few months has been magnified by Russia and Omicron, but still clearly says the market has shifted to a driver surplus. We’re not adding nearly as much equipment capacity as we typically would, which suggests a possibly shorter-than-normal downcycle.”

ACT’s monthly Freight Forecast provides forecasts through 2024 for volumes and contract rates for the truckload, less-than-truckload, and intermodal sectors of the transportation industry, including the Cass Shipments Index and Cass Truckload Linehaul Index. For the truckload spot market, the report forecasts rates through 2022.