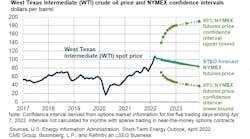

The U.S. Energy Information Administration (EIA) says its April Short-Term Energy Outlook is subject to heightened levels of uncertainty resulting from a variety of factors, including Russia’s further invasion of Ukraine.

Nations, energy producers, and global markets could respond to continued escalation in a variety of ways, EIA said, clouding its forecast. In addition, Russia’s actions came at a time when global inventories of crude oil, natural gas, and coal were below average, contributing to continued price volatility and high prices.

High energy costs are reflected in U.S. gasoline and diesel prices, which hit multiyear highs in March.

In recently published Summer Fuels Outlook, EIA forecasts that the average price of gasoline and the average price of diesel will be the highest inflation-adjusted prices since the summer of 2014.

“EIA will continue to monitor market dynamics in the energy sector and publish updated information to support a fuller understanding of the evolving situation,” the administration said.

The full Short-Term Energy Outlook is available here. Selected highlights include:

Global liquid fuels

The Brent crude oil spot price averaged $117 per barrel (b) in March, a $20/b increase from February. Crude oil prices increased following the further invasion of Ukraine by Russia. Sanctions on Russia and other actions contributed to falling oil production in Russia and created significant market uncertainties about the potential for further oil supply disruptions. These events occurred against a backdrop of low oil inventories and persistent upward oil price pressures. Global oil inventory draws averaged 1.7 million barrels per day (b/d) from the third quarter of 2020 (3Q20) through the end of 2021. EIA estimates that commercial oil inventories in the OECD ended 1Q22 at 2.61 billion barrels, up slightly from February, which was the lowest level since April 2014.

Natural gas

In March, the Henry Hub natural gas spot price averaged $4.90 per million British thermal units (MMBtu), which was up from the February average of $4.69/MMBtu, as inventory withdrawals slightly outpaced the five-year (2017–2021) average. EIA expects liquefied natural gas (LNG) exports will increase from March levels, contributing to a Henry Hub price of $5.95/MMBtu for April. It also expect the Henry Hub price will average $5.68/MMBtu in 2Q22 and $5.23/MMBtu for all of 2022. EIA expects the Henry Hub spot price will average $4.01/MMBtu in 2023. The forecast drop in prices for 2023 reflects our expectation that storage levels will be higher during 2023 than in 2022.

Electricity, coal, renewables, and emissions

U.S. energy-related carbon dioxide (CO2) emissions increased by more than 6% in 2021 as economic activity increased and contributed to rising energy use. EIA expects a 2% increase in energy-related CO2 emissions in 2022, primarily from growing transportation-related petroleum consumption. Forecast energy-related CO2 emissions remain almost unchanged in 2023. EIA expects petroleum emissions to increase by 4% in 2022 compared with 2021, though this growth rate slows to less than 1% in 2023. Natural gas emissions are relatively flat in 2022 and then increase by 2% in our forecast for 2023. The administration forecasts that coal-related CO2 emissions will grow by 3% in 2022 and then fall 6% in 2023.