Jason Miller has been in the tire industry for 44 years, with stints at Continental, Bridgestone, and Hankook Tire, and his vast experience has led him to believe fleets see buying tires as a “grudge purchase.”

“Everyone hates buying tires,” insisted Miller, Cooper Tire & Rubber’s national fleet channel sales manager.

The reason, he maintains, is because fleet managers are responsible for many other areas that affect uptime, such as the diesel particulate filters, brakes, and axles, so tires can become an afterthought.

“If you aren't having a tire crisis, it tends to fall low on the priority list, until you look back over the year, and you look where you spent all your money,” Miller explained. “And tires are one of, if not the single largest, maintenance expense for a fleet.”

The COVID-19 pandemic has made this tightrope-walking act even more precarious, with supply chain disruptions making materials harder to come by. Rubber production has been impeded by COVID-related labor shortages at Asian rubber tree farms, along with the outbreak of a fungal leaf disease. The Singapore Commodity Exchange found rubber prices rose 70% year-over-year from May 2020 to May 2021.

“Tires are hard to come by right now; you’ve got higher prices and lower supplies,” Kevin Rohlwing, SVP of training for the Tire Industry Association (TIA), noted this summer. “We can’t say it’s a shortage, but in certain sizes and certain styles, you’re not going to be able to get them.”

All the while, mileage has increased as consumer demand for goods has risen. These are problems to keep an eye on, but with the right planning, and some new automated technology to help fleets monitor their tire status, it is possible to make it to the other side.

The end goal is having tires that last an acceptable interval, cost an acceptable amount, and have an acceptable availability. Fortunately, there are tools and techniques to turn this grudge purchase into an opportunity to reduce overall maintenance expenses while improving safety and uptime.

Improving tire life cycles

How long a tire lasts usually depends on how efficiently a fleet can manage its tire maintenance.

“Proper fleet maintenance, like any element of a fleet’s culture, must be cultivated and reinforced at all levels of the organization,” said Tom Fanning, head of truck tires for the U.S. market at Continental. “Running a properly maintained fleet is a culture change; it will not happen overnight, but it can dramatically impact the fleet’s long-term success.”

Part of that culture change should be centered around the importance of inflation.

The primary variable to impact life is inflation, indicated by the tire psi level. As the U.S. Tire Manufacturers Association points out, underinflated tires are not only drags on steerability and fuel economy, but the excess friction they generate can cause irregular wear and internal damage, and make them more likely to puncture or blow out.

The bottom line is that underinflation dramatically affects the fleet’s bottom line.

“Some of these fleets are telling me that their breakdowns represent 30, 40, 50% of their tire budget, because of maintenance issues,” Miller said.

He said getting drivers to do proper inspections is one way to mitigate risk and ensure proper inflation. Tire pressure monitoring systems automatically perform this task via sensors on the tire, sending that data to fleet managers for general awareness and affording them the chance to intervene when needed.

“It’s about being proactive and seeing the early signs that could indicate a failure down the line,” said Pierluigi Cumo, marketing director for on-road at Michelin. “We have offers to address the emergency aspect with ONCall (end-to-end breakdown solution), but we also want to use that data to see maybe there's specific spots that fleets need to pay particular attention to.”

Data indicates that this solution does pay off.

“Customers looking for the lowest overall driving cost should strongly consider a digital TPMS, as properly inflated tires get 15% longer tread life on the tire’s first life, and 20% longer casing life for retreading,” said Fanning. “One customer has told us they have reduced roadside service calls to zero by implementing our ContiConnect Yard solution. This type of service around the tire helps our customers maximize their tire investment and reduce downtime.”

Tread is the other important factor.

“If we can get drivers to just walk the fleet and take a hand over the tread and measure it, we can pull a lot of cost out,” Cooper advised, though he admitted that is easier said than done.

On commercial tires, such as the recently launched Cooper PRO Series Long Haul Steer 2, the company implements a Wear Square, a visual indicator on the shoulder ribs that starts as an “A,” and becomes an “L” at half tread life, and an exclamation mark when it needs to be replaced. The difference between the markings on either side of the tire also indicate alignment issues. Misalignments can exacerbate wear.

Goodyear Tire and Rubber Co., which acquired Cooper earlier this year, also has a handheld digital tire tool called Tire Optix, with one end to measure tread depth while the other attaches to the valve stem to check pressure. The data is sent via Bluetooth to a mobile app, which tracks what trucks have problem tires.

“We inspect about 2 million tires a year with Tire Optix, and it's all about creating efficiencies and accuracies during this tire inspection process,” said Jamie Redmond, Goodyear customer engagement specialist.

The next solution: Rollover monitoring

Like materials and repair parts, finding workers also has been made difficult, which makes manual inspections more difficult for certain fleets. And TPMS isn’t always the right fit for all fleets.

A new solution has emerged that is allowing fleets to quickly gather tire data without the use of onboard sensors or extra labor: automated tire inspection systems.

Automated tire inspection systems are fixed stations that detect pressure and tread status as the vehicle drives over or through them. They offer multiple benefits to a fleet and leveraging the benefits such systems offer can aid fleets in prolonging tire life, avoiding premature failures, and creating a set of actionable data to help decision making processes when it comes to ordering and servicing tires.

Goodyear had been using its solution, the CheckPoint drive-over-reader, in Europe for several years and is now making it available to lease in North America.

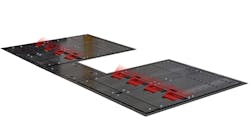

Using micro-transducers, lasers, and cameras to detect tread depth and pressure, CheckPoint can be used for vehicles ranging from passenger vehicles to Class 8 tractor-trailers, with options for in-ground installation or 2-3” ramp style above ground option.

Austin Crayne, Goodyear business development manager, reported one European fleet using CheckPoint “found out that they have about a 90% reduction in labor inspection time on checking tire tread pressure and tread depth.”

“Tires are one of the biggest costs of fleets and labor’s a little scarce, so this really helps you focus your efforts on the tires that have issues that were identified by CheckPoint,” Crayne said.

Trucks can drive over the in-ground option at 11 mph, though the above ground version requires a slower speed. Over one year, a U.S. fleet piloted the technology at three facilities and inspected 2 million tires, Crayne said. And in 2021, the solution has scanned 1.5 million tires and detected 126,000 potential costly issues, according to Goodyear.

Manual inspections of tires can foster subjectivity, and in some cases ‘pencil whipping’—completing the task quickly just to get through it, according to Michael Bush, Director of U.S. fleet sales at UVeye, which makes the Artemis automated tire inspection system.

“Our system is based on the combination of artificial intelligence and machine learning and computer vision, and then through those technologies is able to understand what a normal tire should look like,” Bush explained. “Through that technology, when it sees tires that don’t look like that, and it has issues such as a cut, a bulge, a chunk taken out of the tire, tread that either indicates misalignment or that is of low tread depth, the technology can identify—versus a standard tire—this is not supposed to be there.”

This ensures each tire was inspected accurately every time, and helps avoid roadside breakdowns caused by tire failure.

“It takes the guesswork, the subjectivity, out of a manual inspection and uses computer technology to identify those anomalies that shouldn’t exist in a tire and can lead to an accident,” Bush asserted. “If you’re able to detect an issue, such as a cut or a bulge, you would change that tire out before the vehicle gets on the road.”

Hunter Engineering Co.’s Quick Tread Heavy-Duty automated tire inspection system provides fleets the ability to “get a quick glimpse of the state of that vehicle within a matter of seconds as it passes through, and there is no human involvement at all,” said Tommy Maitz, Director—marketing at Hunter.

“Vehicles that come through our system on a nightly basis after they finish their runs, and if they see something like a screw in the tire, the Artemis system can alert the fleet manager and the fleet manager would have real time eyes on the equipment, even remotely,” Bush said. “They can identify the requirements for maintenance to change that tire in-between shifts, so when the next morning comes, that vehicle is going to be in perfect working condition, and you don’t have the threat of a blown tire on the road.

“In terms of low tread depth, the system is going to identify if and when you should schedule the maintenance of the tires, and specifically, for changing them out,” Bush stated. “So again, remotely, a fleet manager could identify which vehicles are in line for tire upgrades. It gives them that intelligence to plan accordingly.”

Bush said fleets can customize the Artemis system according to their specifications. For instance, a fleet can set up a critical alert on tread depth according to the depth they wish the alert to be sent—such as when a tire reaches 4/32.

When a fleet is trying different tires, or their routes and duty cycles have been adjusted, automated tire inspection systems can even provide insight for a fleet into which tires are performing best for their use cases.

“The other thing that we’re able to do is to identify the specific type, date, manufacturer, size, load, and speed of the tires, through our detection,” Bush said of the Artemis system. “You’re able to understand, on a tire basis, which specific brands are performing best for your fleet.”

Leveraging the data

One of the best advantages of automated tire inspection systems is the data provided.

For instance, Goodyear customers can set up the CheckPoint data to be sent to Fleet Central or another maintenance platform.

“The key part is around the connectivity of the tire to the vehicle and to the service network,” noted Johnny McInstosh, director of Integrated Solutions & Tire Management Services at Goodyear. “And you're going to get more out of your tires—you're going to be able to retread more, because you're not going to be running them underinflated, or running mismatched in a dual configuration.”

Using Hunter’s Quick Tread Heavy-Duty, data is pushed to Flight Board, a portal providing an overview of the results from the inspection. Results are provided displaying pass or fails, tire status, and all data is visually represented through images and diagrams to provide quick, actionable, and accessible information.

Furthermore, reports can be customized and generated as a fleet sees fit. For instance, Maitz explained, a fleet maintenance manager can have a report generated to be sent at the end of the day containing all the results, or an afternoon report of the morning’s results, or more. This flexibility allows a fleet to have the data sent to the right people at the right time to assess situations, plan procedures, and act accordingly.

The Artemis system also generates reports and provides notifications to those the fleet wishes to share that information with. The ability to share that information promotes an efficient maintenance operation.

“A best practice to understand: Because we’re capturing critical information, we want to make sure that we keep the right people in the loop,” Bush said. “So, make sure that the appropriate team, and that could be anyone from the fleet manager, safety manager, maintenance manager, and the driver, is to be included in any critical alerts.”

All industries are having to navigate a climate of supply chain disruption, and though fleets are typically looked at as a key to solving supply chain issues, they too face issues in getting the parts, and tires, they need. Working closely with suppliers, and seeking the latest technologies available for adoption, can help relieve the burden of operating business as usual in a time when things are anything but.