Report: Tank/bulk driver pay increases, benefits expand in 2021

Kim Beck is happy with bulk carriers.

The vice president of benefits consulting at Cottingham & Butler said 30 more liquid and dry bulk carriers participated in the 2021 Trucking Benchmark Driver Compensation & Benefits Survey than in the 2020 version, making this year’s tank and bulk-specific data more accurate and useful for tank truck-industry stakeholders.

“The data that we include in our (all-trucking) survey is from several hundred motor carriers across the country,” Beck said during National Tank Truck Carrier’s 2021 Annual Conference in Indianapolis, Ind. “It’s pretty well spread across all states—there’s only a few states where we don’t have representation right now—and it’s primarily truckload, non-union, for-hire, and private fleets, and no bus, rail or airlines, so it’s strictly motor carriers. And as of this year’s survey, we have over 70 carriers in the tank/bulk segment that participated.

“There are hundreds more out there, but we’re really excited because that’s about a 40% increase over last year, so thank you to all of the newbies.”

For survey purposes, participants were categorized as tank or bulk based on which segment included 50% or more of their business. For 2021, 63% of motor carriers surveyed reported a majority of hauls were with tank trailers, and 44% reported most were with dry bulk trailers (respondents could select more than one).

The 2021 report includes insights into driver compensation, bonus structures, and non-driver compensation, and details about the many different company-paid and voluntary benefits packages available.

“With her industry expertise and over a decade of data from this annual survey her team has also developed analytical tools and deeper-level benchmarking resources to assist trucking companies with strategies for containing costs and making important benefits-program decisions each year,” said Kevin Jackson, president of Liquid Cargo.

The caveat, Beck said, is data was collected in the first quarter of the year, before many trucking companies, including tank truck carriers like Carbon Express, Groendyke Transport, J&M Tank Lines, and Service Transport Company, announced increases in their compensation packages, potentially skewing results. “When people were completing this survey in February, it was before a lot of the pay raises that happened in the last couple of months, and some of the new sign-on bonuses we’re seeing,” she said. “So the benefits responses are probably current and relevant, but on the pay side we’re going to see some differences.”

Compensation

Beck focused on key items that impact recruiting and retention in her presentation, including home time, length of haul, and turnover.

With length of haul, 50% of tank/bulk carriers reported their runs, on average, were short hauls (less than 201 miles), 29% said average hauls covered intermediate distances (201-500 miles), and 7% said typical runs were long hauls (501-plus miles), a decrease from 15% in 2020—and much lower than Beck sees in the overall industry. “That’s awesome because it probably means your drivers are home more often, which is what they want,” she said.

Tank/bulk drivers were home every night according to 43% of respondents, three or more nights per week in 21% of surveyed operations, and one to two nights per week in 33%. Carriers reporting they get drivers home every night increased from 37% last year. Many dry-van and refrigerated carriers have drivers who make it home only one or two nights per month, Beck said. No one is in that category in tank/bulk.

Average voluntary turnover was 31%, though Beck said that number likely increased after the survey closed. No tank/bulk carrier reported 91-100% turnover, which isn’t unheard of in the all-trucking segment, Beck said. Eighty-six percent of tank/bulk companies reported turnover below 50% in 2021, compared to 64% in 2020. The most fruitful method for recruiting drivers in the tank/bulk segment still is word of mouth, with 69% of respondents reporting success with this method, followed by social media (64%), and driver referrals (57%).

Once hired, most tank/bulk drivers, 79%, are receiving hourly compensation (although respondents, again, could select more than one option), followed by percentage of revenue/load (62%), mileage pay (52%), and salary or per-day pay (14%). Average annual compensation was $70,500 for drivers paid by the mile, $70,800 for percentage, $63,400 for hourly, and $55,700 for salary. Drivers in the 75th percentile averaged $75,000 in the top three categories.

Beck said average pay increased 10% year-over-year in the tank/bulk segment. “We’ve seen this driver-pay average increase every year now since we’ve been doing this survey, and this year was the most significant increase we’ve seen,” she said.

Average per-mile pay was 55 cents for tank/bulk drivers with less than three years of tenure, 58 cents for three to six years, and 61 cents for more than six years. Those numbers are lower in other segments, Beck said. Forty-five percent of per-mile drivers made $60,000 to $69,999—and no carriers that pay by the mile had drivers averaging more than $100,000 per year.

Compensation by revenue or load increased the most. “We saw a 10-15% increase over the last 18 months in the amount of average pay for the drivers they’re paying by percentage of revenue or load,” Beck said. “On the tank side they were slightly higher, at $74,700 average annual pay, and bulk was $68,300.” As with mileage, 45% averaged $60,000 to $69,999 per year, but 4% of carriers paying by percentage reported drivers averaging more than $100,000 per year.

Hourly tank/bulk drivers averaged $63,400 annually, up 3.4% from 2020, and salaried, or per diem drivers averaged $55,700. “In over-the-road trucking—dry van, refrigerated, and the other segments of trucking—per diem is a little more popular and a little higher pay because they’re out longer,” Beck said. “There’s more of a justified reason for paying per diem.”

However, 59% of tank/bulk carriers said they’re now awarding per-diem pay for drivers who are out overnight, up from 30% last year. The average daily per diem was $40, and average annual per-diem pay was $5,500. “I’m seeing a trend here, as motor carriers are getting more creative at how to pay their drivers more,” Beck said. “Per diem is not taxable to them, so that creates a nice conversation around how to make more money.”

The top three bonus categories were referrals, safety, and clean DOT inspections. Average annual referral bonuses were $1,370, safety bonuses averaged $1,350 annually, and inspection bonuses averaged $95 per occurrence. Sign-on bonuses averaged $1,825—but Beck said she’s now seeing them as high as $10,000—tenure and retention bonuses averaged $1,400 per year, and fuel-efficiency marks paid out $1,065 yearly.

Benefits

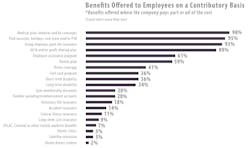

Most tank/bulk carriers offer employees medical plans (98%); paid vacation, holiday, sick leave, and/or PTO (95%); group employer-paid life insurance (93%); 401K and/or profit-sharing plans (89%); employee assistance programs (61%), and dental plans (50%), and 14 other types of benefits were mentioned, including on-site fitness centers (2%).

Benefits offered on a voluntary basis, in which the carrier does not contribute to the cost, include voluntary life insurance, offered by 73% of respondents, accident insurance (70%), critical illness insurance (66%), short-term disability (57%), and long-term disability (55%). Beck said more companies are offering additional or new voluntary benefits as they look for ways to expand offerings without increasing costs. Thirty-seven percent more employers offered accident insurance and 53% more employers offered critical illness insurance in 2021 compared to 2020.

Paid days off also increased across the board in 2021, with employees with five-plus years on the job averaging 15 days of PTO, in addition to paid vacation, sick leave, and holidays.

More tank/bulk carriers also reported offering a 401K with company contributions, and average company matches increased, with 56% reporting a 3-4% match.

Twenty-three percent of companies offered one medical plan, 50% offered two, and 27% offered three. Ninety-five percent are offering PPO plans with varying deductibles, Beck said. The 2021 report further breaks down medical-plan types and associated employer costs. “We’ve seen an increase in those with self-funded plans, and also in stop-loss captives, or benefit captives,” she said. “Those are becoming more popular, more attractive, and more competitive. So that’s new on the horizon as well, and growing.”

Consumer-driven medical plan offerings are high-deductible health plans with no office visit co-pays, and no drug card co-pays, and often have health savings accounts (HSAs) associated with them, forcing people to make consumer decisions on health care, but only 40% of tank/bulk carriers offer these plans. “I could spend an hour talking about this, and how to do this and make it work and save money, but at the end of the day, in your segment, it’s still not as common to have consumer-driven health plans,” Beck said. “It’s more common to have a traditional health plan, with a deductible, co-insurance, office co-pay, and drug card co-pay. That’s what drivers want.”

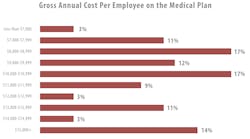

The average gross annual cost per employee on a medical plan was $10,815, up from $10,652 last year. Average medical-plan participation is 80%.

The report dives deeper into medical plan and benefit design and costs, and how those impact deductibles, Beck said. “What was most stunning to me is that rates charged for employees in the bulk segment went down slightly in all tiers except family (plans),” Beck said. “So I’m not sure what happened but I think … (with) more of you who are offering multiple plans, more employees chose the higher-deductible, lower-cost plans.”

Further benefits information includes cost-containment strategies, like working spouse provisions, incentives for declining coverage, and tele-medicine, which has grown, with 87% of tank/bulk carriers now offering the option.

Most importantly, Beck said, no one in the segment had owner-operators on employer-sponsored benefit plans. “I’m really proud of you because last year when I did this survey, 3% were still allowing owner-operators, if you have them, on your health plan, which is a big no-no,” she said. “That went to 0% this year, so good job on that. There are association programs out there you can use to offer benefits to your contractors.”

The full Trucking Benchmark Survey report typically is only made available to participants, and the separate tank/bulk-specific report also is made available to NTTC members, so they’re not accessible by the general public. Motor carriers who didn’t participate in the 2021 survey can contact Beck at [email protected] or 563-590-8210, or visit truckingsurvey.com, for more information or to learn how to participate in the 2022 survey.

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.