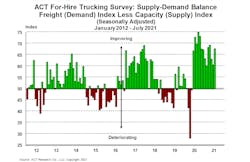

The latest release of ACT’s For-Hire Trucking Index, with July data, showed an uptick in volumes and pricing moderating, with a still-strong supply-demand balance.

The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. ACT Research converts responses into diffusion indexes, where the neutral or flat activity level is 50.

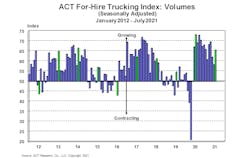

“The reacceleration in truck volumes is consistent with strong demand for inventory restocking ahead of the holidays, along with network congestion on the railroads,” said Tim Denoyer, vice president and senior analyst at ACT Research. “With tight inventories, strong U.S. consumer balance sheets, improving capex, and infrastructure stimulus in the pipeline, the fundamentals of the freight cycle remain clearly positive.

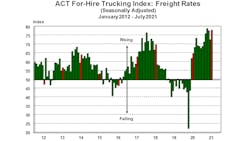

“As volume growth reaccelerated, ACT’s For-Hire Pricing Index increased, making July’s reading the second best since the survey’s inception in June of 2009. With the driver market still tight, new equipment production still challenged, and demand still strong, the recipe is right for record rate increases.

“However, driver hiring has begun to improve since the extended unemployment curtailments started in June, and response to higher driver pay rates should lead to more gradual progress.”

Regarding the supply-demand balance, Denoyer noted, “July’s strong 67.6 reading reflects the tightness in the current freight environment, with capacity remaining constrained and the increase from June primarily due to higher volumes. Class 8 retail sales are constrained by tight inventories and unmet production demand due to parts shortages, so equipment capacity is behind demand. With some structural driver issues likely to outlast the pandemic and a positive freight demand outlook, we do not expect the market balance to move quickly.”

The ACT Freight Forecast provides forecasts for the direction of truck volumes and contract rates quarterly through 2020 with three years of annual forecasts for the truckload, less-than-truckload, and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months.

In 2019, the average accuracy of the report’s truckload spot rate forecasts was 98%.