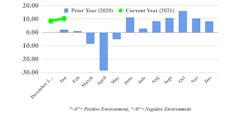

FTR’s Trucking Conditions Index (TCI) rebounded in January to a +10.37 reading, roughly matching the November index reading.

The December TCI was +8.51. Stronger freight rates and volume more than offset higher fuel costs in January, according to FTR Intel. Rising fuel costs are expected to have a more negative impact on the February TCI, but the index will remain strong because freight market dynamics are solidly in carriers’ favor.

FTR’s latest forecast calls for stronger freight demand through 2021, and the industry analyst expects positive trucking conditions through 2021 even if the current tight driver market were to loosen somewhat as the pandemic fades.

“Market conditions are close to the best ever for trucking companies, and they should remain that way at least through this year,” said Avery Vise, FTR’s vice president of trucking. “With stimulus from Washington, extraordinarily lean inventories, and a fading pandemic, solid freight demand is practically baked in.

“The bigger risk to good times is that driver capacity comes back too strongly as labor participation rebounds, but with the pipeline of new drivers constricted for the past year, that risk seems low. Trucking’s weak payroll jobs numbers for January and February even as freight volume is strong suggests that the principal issue is the supply of drivers, not demand for them.”

Details of the January TCI are found in the March 2021 issue of FTR’s Trucking Update, published Feb. 26. Additional commentary discusses how risks to our forecasts are shifting from freight demand to driver availability.

Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, and rates.

The TCI tracks the changes representing five major conditions in the U.S. truck market: freight volumes, freight rates, fleet capacity, fuel price and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.