EIA: U.S. crude oil, natural gas production to continue fall in 2021

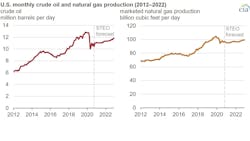

The U.S. Energy Information Administration (EIA) says U.S. crude oil and natural gas production will continue to decline this year.

In its January 2020 Short-Term Energy Outlook (STEO), the agency’s forecast predicts U.S. crude oil production will average 11.1 million barrels per day (bpd) in 2021, down 0.2 million bpd from 2020 as a result of a decline in drilling activity related to low oil prices.

A production decline in 2021 would mark the second consecutive year of declines, as responses to the COVID-19 pandemic led to supply and demand disruptions. But EIA said it expects crude oil production to increase in 2022 by 0.4 million bpd because of increased drilling as prices remain at or near $50 per barrel.

The United States set annual natural gas production records in 2018 and 2019, largely because of increased drilling in shale and tight oil formations. The increase in production led to higher volumes of natural gas in storage and a decrease in natural gas prices. In 2020, marketed natural gas production fell by 2% from 2019 levels amid responses to COVID-19.

EIA estimates annual U.S. marketed natural gas production will decline another 2% to average 95.9 billion cubic feet per day in 2021. The fall in production will reverse in 2022, when EIA estimates that natural gas production will rise by 2%.

EIA’s forecast for crude oil production is separated into three regions: the Lower 48 states excluding the Federal Gulf of Mexico (GOM) (81% of 2019 crude oil production), the GOM (15%), and Alaska (4%). EIA expects crude oil production in the U.S. Lower 48 states to decline through the first quarter of 2021 and then increase through the rest of the forecast period. As more new wells come online later in 2021, new well production will exceed the decline in legacy wells, driving the increase in overall crude oil production after the first quarter of 2021.

Associated natural gas production from oil-directed wells in the Permian Basin will fall because of lower West Texas Intermediate crude oil prices and reduced drilling activity in the first quarter of 2021, the administration added. Natural gas production from dry regions such as Appalachia depends on the Henry Hub price. EIA forecasts the Henry Hub price will increase from $2.00 per million British thermal units (MMBtu) in 2020 to $3.01/MMBtu in 2021 and to $3.27/MMBtu in 2022, which will likely prompt an increase in Appalachia's natural gas production.

However, natural gas production in Appalachia may be limited by pipeline constraints in 2021 if the Mountain Valley Pipeline (MVP) is delayed. The MVP is scheduled to enter service in late 2021, delivering natural gas from producing regions in northwestern West Virginia to southern Virginia. Natural gas takeaway capacity in the region is quickly filling up since the Atlantic Coast Pipeline was canceled in mid-2020.