Drivers in tank truck fleets are less likely to look elsewhere than their peers in other sectors of the trucking industry, according to data collected in Cottingham & Butler’s 2020 Trucking Benchmark Driver Compensation & Benefits Survey.

The Iowa-based insurance broker’s Kim Beck, vice president of benefits consulting, and Eddie Rios, account executive, discussed those findings and more—with survey topics including driver retention and compensation, driver bonuses, and the various health plans and wellness programs offered by motor carriers—during a tank- and bulk-specific webinar overview presented by the National Tank Truck Carriers’ Tank Truck University.

Cottingham & Butler is the official sponsor for all TTU webinars.

“Beck specializes in benefit program design, compliance services, onboarding and enrollment technology specific to the transportation industry,” said Maggie Walsh, manager of education and regulatory compliance with NTTC. “She facilitated the development of the annual Trucking Benchmark report, and now has access to a decade of data from the survey, helping her develop analytic tools and deeper-level benchmarking resources to assist trucking companies with strategies for containing cost and making important benefit program decisions.

“Each year hundreds of motor carriers rely on Cottingham & Butler Tracking Benchmark survey data to compare their benefit and compensation offerings to the broader trucking industry, and make necessary adjustments to attract and retain drivers in a competitive market.”

Cottingham & Butler surveys all trucking companies for a larger report, then works with NTTC to generate a report specific to the tank and bulk segments of the trucking industry. Beck said several hundred motor carriers from across the country, primarily truckload or over-the-road, non-union fleets, participated in the annual survey, and close to 80 tank or bulk carriers were included in this year’s data. For survey purposes, participants were categorized as tank or bulk carriers based on which segment included 50% or more of their fleet business. For 2020, 62% of participants were tank haulers and 36% were bulk haulers.

Low turnover

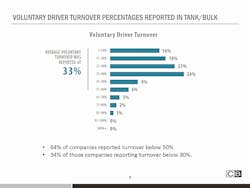

The average voluntary driver turnover percentage—or percentage of those employees who chose to leave the company—reported in the tank and bulk segments was 33%, Beck said. Twenty-four percent reported turnover between 31% and 40%, 21% reported turnover between 21% and 30%, 18% of participants had less than 20% turnover, and 16% were between 1% and 10%, which Beck said is impressive.

Overall, 64% of bulk/tank companies reported turnover of less than 50%, and 34% of those companies reported turnover below 30%.

“As far as turnover goes, we’ve seen a wild variation in turnover over the years in our data that was reported, but I will tell you that in the tank and bulk segment the turnover tends to be much lower than in dry van and other segments of the trucking industry,” Beck said. “You guys are obviously getting your drivers home more often, it’s more specialized, and clearly you’re doing something right in terms of culture and retention, because having lower than a 50% turnover average for going on six years now is very impressive.

“Keep in mind all of this data was collected pre-COVID, so we know that will skew some of this going forward, and it’ll be interesting to see how the numbers change going into next year. But, for the most part, drivers are not turning over as much now, with everything going on, which is a good thing, so hopefully that brings down the numbers.”

Attracting drivers

The majority of participants were short haul or regional fleets, with 51% of tank and bulk carriers surveyed saying a majority of their hauls traveled less than 200 miles, and 25% reporting between 200 and 500 miles per haul. “We noticed that the carriers reporting zero to 200 miles, so the shortest length of haul, actually increased from 2019 to this year, from 40% to 51%, so what it’s telling me is that you guys are getting more strategic around getting your drivers home more often, and shortening the length of where they’re hauling to,” Beck said. “And maybe that’s just a logistical change. We all know drivers want to get home more often. But that’s an interesting statistic, and it’s really a positive thing for those drivers.”

Bulk and tank carriers also lead the trucking industry in average nights spent at home, which is a key factor in driver recruitment and retention, with 37% of participants saying their drivers are home every night—which Beck said was a surprisingly high percentage—and 33% saying their drivers are home three or more nights per week. That adds up to 70% of carriers surveyed saying their drivers are home at least three nights per week, and in the all-trucking and over-the-road, dry van segments, getting drivers home one to two nights a week is a “big task,” Beck maintained.

Tank truck carriers are using a variety of methods to recruit drivers, with 67% of survey respondents—who were allowed to choose more than one method of recruiting—saying they recruit through word of mouth. Sixty-one percent use billboards, 40% have a driver referral program, 24% utilize radio ads, 9% take out print ads—and only 1% are using social media, which Beck said was lower than expected in today’s climate.

“(Social media use) was much higher in the all-trucking segment,” Beck said. “So, for whatever reason, in the tank/bulk segment, social media is not as popular. But I think that will grow, and you probably all should be considering more use of that for recruiting and retention, especially if we’re trying to hire and recruit younger drivers into our industry.”

Driver compensation

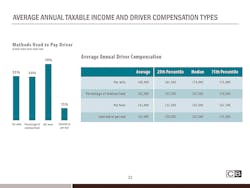

Cottingham & Butler also asked participants about driver compensation, with questions covering average pay, popular payment methods, bonuses and more.

When asked what type of pay is used for drivers, 55% of tank and bulk carriers said they pay drivers by the mile, 54% pay based on a percentage of the revenue or load, 70% pay some or all of their drivers per hour, and 15% offer salary or per diem pay.

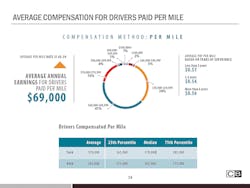

Within the segment paying by the mile, average driver pay was $69,000 per year, Beck said, and the 75th percentile of per-mile drivers made $75,000 or more. Drivers earning their pay based on a percentage of the revenue or load averaged $65,000 per year, hourly drivers made $63,000, and salaried drivers averaged $65,000 a year.

Broken down by pay per hour, drivers compensated through the per-hour method benefited from seniority, with pay in line with tenure. Drivers with less than three years of driving experience or time with the company averaged $23.26 per hour, drivers with three to six years of service made $24.51, and drivers with six or more years averaged $25.25.

“What’s interesting here is the pay for those hauling tanks was higher, at $65,500 per year, than for bulk, at $55,000 per year,” Beck added. “Some of that has to do with what hazmat certification they have, where they’re hauling and what area of the country as well, so we know this does vary by market.”

Average pay using the per-mile compensation method was 51 cents per mile for drivers with less than three years of experience, 54 cents for three to six years and 56 cents for six-plus, which Beck said is high compared to the all-trucking segment. Broken down by tank and bulk, tank drivers averaged $70,000 pear year through the per-mile method, and bulk drivers averaged $63,000 annually.

Beck said they saw a slight increase in pay from 2019 to 2020, but not as dramatic an increase as the one from 2018 to 2019. “That was when the driver shortage was hitting pretty hard,” she explained.

Average annual salary for drivers compensated by revenue or load percentage was $65,000, with tank averaging $67,000 and bulk $60,000. For drivers paid by salary or per day, average annual pay was $65,000 for tank drivers and $63,000 for bulk drivers, which is similar across all trucking segments since fewer motor carrier use this type of compensation method.

Per diem pay isn’t as common in the bulk/tank segment, because so many of these carriers are getting drivers home three or more days per week, Beck said, but the average per diem daily rate paid was around $35 per day—with the average annual rate paid to drivers at $2,000—compared to $50 to $60 per day in dry van transport.

Bonuses

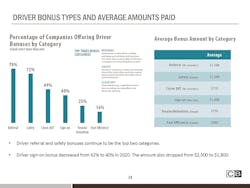

The most common type of bonus paid was a referral bonus, with 79% of bulk/tank carriers surveyed saying they offer rewards for referrals. Seventy-two percent are paying bonuses based on safety criteria built into company programs, 49% are paying for clean Department of Transportation inspections, 40% offer sign-on bonuses, 25% boast tenure and retention bonuses, and 16% of participants include fuel-efficiency payouts.

Carriers awarded an average of $1,300 per year in referral bonuses, $1,200 for safety achievements, $110 per clean DOT inspection, $1,800 in one-time sign-on bonuses, $750 in tenure and retention pay, and $900 for fuel-saving rewards.

Sign-on bonus usage decreased from 2019 to 2020, Beck said. Last year, 62% of respondents said they used signing bonuses to attract new drivers, and this year only 40% reported offering them as the driver shortage abated. “We all have mixed feelings on sign-on bonuses,” Beck said. “Drivers may come to you for a sign-on bonus, but it also incents them to leave for one, so it’s a slippery slope, but you’ve got to do what you’ve got to do.”

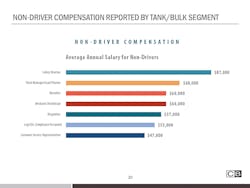

Survey data also included information on non-driver compensation, and safety directors led the way, averaging $87,000 annually, followed by fleet managers/load planners ($68,000), recruiters ($60,000), mechanics/technicians ($60,000), dispatchers ($57,000), Log/CDL compliance personnel ($53,000), and customer service representatives ($47,000).

The size of the company has a big impact on how much the safety director is paid, Beck said, as does the type of product hauled. The most specialized fleets, typically with hazmat certifications, report paying their safety directors $100,000 or more per year, with 16% of carriers paying safety directors in the $70,000 range.

Further results

To promote driver health, carriers in the bulk/tank segment support wellness initiatives through a variety of offerings, including walking challenges and step competitions, on-site fitness equipment, weight loss challenges and discounts, disease or condition management, health risk assessments and smoking cessation programs.

Beck and Rios also touched on other data in the Trucking Benchmark report, including insights into average benefits cost per employee; and cost containment strategies like tele-medicine, which they said is fast becoming the norm, and opt-out benefits for employees who wave health-plan coverage when they have other options.

Beck warned against allowing owner-operators to use company health plans, saying it’s not a good way to handle risk.

“For those of you still allowing owner-operators or independent contractors to be covered on your company health plan, you should probably rethink that as it creates misclassification risk that you do not want,” she said. “The best practice is to offer something through an association where there’s no employee-employer language, something where that association can offer them benefits through a group-discounted type of program.”

The full Trucking Benchmark Survey report typically is only made available to participants, and the separate bulk/tank-specific report is made available to participants and NTTC members, so they’re not accessible by the general public.

Motor carriers who didn’t participate in the 2020 survey can contact Beck at [email protected] or 563-590-8210, or visit truckingsurvey.com, for more information or to learn how to participate in the 2021 survey.

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.