ACT’s For-Hire Trucking Index: Bottoming process underway?

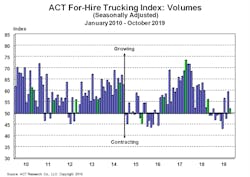

The latest release of ACT Research’s For-Hire Trucking Index, with October data, showed a modest Volume Index, at 52.0 (SA).

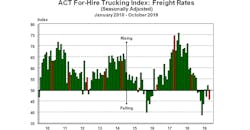

October’s slower growth followed a sharply stronger 59.6 in September. The Pricing Index returned to negative territory in October, at 45.8 (SA), after recovering with volumes in September, at 52.5.

The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. ACT Research converts responses into diffusion indexes, where the neutral or flat level is 50.

For-hire executives interested in participating can contact ACT at [email protected]. In return, participants receive a detailed monthly analysis of the survey data, including volumes, freight rates, capacity, productivity and purchasing intentions, plus a complimentary copy of ACT’s Transportation Digest report.

“The freight industry improvement has not been broad-based in the past few months, and we continue to see plenty of evidence that points to inventory building ahead of tariffs as a key driver of recent performance, though strong consumer trends are also helping,” said Kenny Vieth, ACT’s president and senior analyst.

“With still-aggressive private fleet growth and a weak US manufacturing sector, choppy results will likely continue, but the past few months suggest a bottoming process is underway.”

In a reflection of the imbalance between demand for freight services and the supply of Class 8 trucks competing for freight, Pricing Index shows the path to rising profitability is not yet apparent.

“After collapsing in Q2, the pricing environment stabilized in the past few months,” Vieth said. “October’s lowest-since-June print suggests that pressure from capacity growth persists in the near to mid-term.

“That said, spikes in freight volumes, akin to what occurred in September, could perhaps lift rates on a one-off basis again, ahead of threatened tariffs in December.”

The ACT Freight Forecast provides forecasts for the direction of volumes and contract rates quarterly through 2020 with three years of annual forecasts for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months.