Reports: ‘Beleaguered’ market sinks Class 8 orders

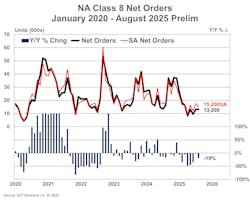

North American Class 8 truck orders in August increased from the prior month by decreased year-over-year by double-digit percentage points, according to the latest reports from ACT Research and FTR Intel.

ACT reported heavy-duty tractor orders of 13,200 units, a 19% y/y decline.

“A beleaguered for-hire market continues to weigh on Class 8 orders,” Tim Denoyer, ACT vice president and senior analyst, said in a news release. “With elevated uncertainty, particularly around equipment costs, and soft activity in housing and broad freight demand outside of pre-tariff activity, this environment may persist.

“Fleet margin pressure has not abated, with contract rates hardly budging and cost pressures ongoing. Vocational demand has taken its knocks as well this year on a combination of regulatory uncertainty, tariffs, and elevated interest rates, though data centers remain an area of strong activity.”

FTR outlook remains ‘unsettled’

FTR registered net orders of 13,000 Class 8 truck and tractor units, up 4% month-over-month but down 14% y/y, marking the eighth straight month of annual decline. Orders were well below the August 10-year average of 23,135 units, reflecting continued fleet caution amid trade frictions, tariff volatility, and broader economic uncertainty weighing on freight demand.

Orders have totaled 251,997 units over the last 12 months, FTR added.

For the 2025 order cycle (September 2024-August 2025), cumulative orders fell 15% y/y, signaling headwinds for OEM production planning and supplier networks. Absent a rebound in freight fundamentals, FTR expects fleet order activity to remain muted as the 2026 order boards open this month, limiting near-term capacity additions and delaying freight rate recovery.

“The N.A. Class 8 truck and tractor market faces growing pressure from tariffs, near-record inventory, regulatory uncertainty, and weak freight demand,” said Dan Moyer, FTR senior analyst for commercial vehicles. “Tariff increases imposed on Aug. 7 raised costs on vehicles, parts, and key inputs. A recent federal appeals court ruling casts doubt about the legality of country-specific ‘reciprocal’ tariffs, although those tariffs remain in place until at least Oct. 14, pending U.S. Supreme Court review. By contrast, Section 232 tariffs on steel, aluminum, and copper are unaffected by that court ruling and may soon expand to trucks, components, and semiconductors, adding further risk.

“Uncertainty over 2027 EPA NOx standards is already delaying some fleet purchases and softening near-term demand, while tariff pressures could further suppress 2026 order activity. Fleets are extending truck lifespans and incurring higher maintenance costs. Suppliers are squeezed by input inflation and uneven demand. Dealers are leaning on used equipment and service. And OEMs face profitability pressure, volatile schedules, and greater supply chain exposure.

“Until tariff and regulatory paths are clarified, the outlook will remain unsettled.”