Reports: Truck orders dip in July

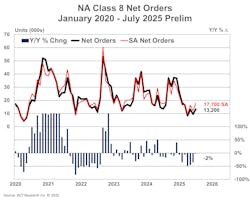

Preliminary Class 8 orders in July increased from the previous month but declined year-over-year, according to new data from FTR Intel and ACT Research.

FTR reported North American net orders for 12,700 units, which is up 42% month-over-month but down 7% year-over-year—the seventh consecutive y/y slide. Orders remained notably below July’s 10-year average of 19,974 units, underscoring persistent caution among fleets amid trade tensions, fluctuating tariffs, and ongoing economic uncertainty impacting freight demand.

Although both vocational and on-highway segments improved m/m, the on-highway market primarily drove the y/y decline, highlighting particular vulnerability among carriers focused on longer-haul operations, FTR added. For the 2025 order cycle (September 2024-July 2025), total orders were down 15% y/y.

Orders have totaled 254,349 units over the last 12 months.

“Ongoing tariff volatility and broader economic and truck freight market sluggishness continue to negatively impact the Class 8 market, driving a substantial 30% y/y decline in year-to-date net orders,” Dan Moyer, FTR senior analyst for commercial vehicles, said in a news release. “Class 8 market uncertainty is further elevated due to the potential imposition of Section 232 tariffs specifically targeting Class 4-8 trucks, tractors, and related components. The lack of clarity regarding potential Environmental Protection Agency revisions to 2027 NOx emissions standards adds to the uncertainty. As a result, many fleets are delaying commercial vehicle equipment investments. Meanwhile, continued record-high inventory levels are placing additional downward pressure on Class 8 production.”

Economic softness weighs on demand

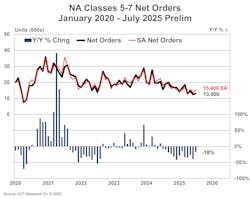

Preliminary Classes 5-8 net orders of 26,200 units declined 10% y/y, according to ACT’s estimate.

“While the economy continues to grow, expanding 3.0% quarter-over-quarter in Q2, uncertainty, elevated equipment prices, and emerging signs of economic softness are all weighing on commercial vehicle demand,” shared Carter Vieth, ACT research analyst. “Solid freight generating segments like housing and manufacturing are sluggish, with manufacturers shedding labor the past three months. Consumers continue to spend, but tariff-related price increases and a weakening labor market may weigh on goods spending in the near term.

“Preliminary Class 8 orders totaled 13,300 units, down 1.9% y/y. Preliminary Classes 5-7 orders fell 17% y/y to 13,000 units.”