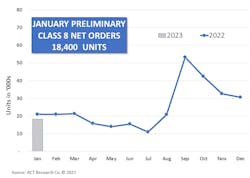

Preliminary North American Class 8 net orders fell again in January, according to two commercial vehicle research firms that released preliminary data on the opening month of 2023. According to researchers, the more sluggish January is not surprising, with OEMs still working to fulfill a backlog of orders.

After reaching record-high orders in September, FTR Transportation Intelligence reported 21,600 units were ordered in January, a 25% drop compared to December. ACT Research put January’s number even lower, at 18,400 units.

“Given how robust Class 8 orders were into year-end, the relative pause in January is not surprising,” according to Eric Crawford, ACT VP and senior analyst.

ACT reported that nearly 159,000 Class 8 net orders were placed over the final four months of 2022, 92% more than the same period in 2021; and only 8% below those placed over the same period in 2020. January’s orders represent the first year-over-year decline since August, Crawford said.

But FTR’s January 2023 preliminary numbers are up 2% compared to January 2022. The firm said 303,000 Class 8 orders were made over the past 12 months. With backlogs already solidifying production slots, it makes sense that orders would fall from the previous torrential pace, according to FTR.

“Orders remain above replacement demand levels but are below recent production activity. As such, backlogs likely moved slightly lower in January,” said Eric Starks, FTR’s chairman of the board. “Putting the order numbers into perspective is important. In the first half of 2022, orders averaged just shy of 18,000 units per month. This suggests that recent activity is healthy, and January itself is up 2% year-over-year. This type of activity by fleets indicates that they are not overly concerned about an economic recession and continue to lock in build slots for the second half of 2023.”

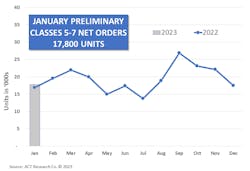

Medium-duty demand remains ‘healthy’

North American Classes 5-7 orders, which is how ACT Research defines medium-duty, were 17,800 in January, according to ACT’s State of the Industry: Classes 5-8 Vehicles report.

“Medium-duty demand was comparatively healthy,” Crawford said. “January Classes 5-7 orders rose 5% year-over-year (+2% month-over-month) to 17,800 units. The seasonally adjusted January intake, at 18,100 units, was +4% year-over-year (+12% month-over-month).”

Both firms said they would release final data on January orders later this month.

This article originally appeared on FleetOwner.com.

About the Author

Josh Fisher

Technology Editor

FleetOwner Editor-in-Chief Josh Fisher has been with Endeavor's Commercial Vehicle Group since 2017, covering everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, regulations, and emerging transportation technology. He is based in Maryland.