Trailer orders surge amid cautious industry outlook

December trailer orders beat year-ago levels by a better-than-expected 5%, with 25,300 units booked last month—which was a 112% increase from November 2025, according to new data from ACT Research. But the firm continued to strike a cautionary tone, noting that December’s trailer-order cancellation rate remained high—particularly in the tank truck segment.

“December’s cancellation rate, as a percentage of backlog, remained high at a more subdued 1.8% versus November’s 2.5% rate,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release. “Data continued to show elevated cancellations in the van and tank segments.

“The highest cancellation rates came from the tank segments, attributed to a decline in oil/gas activity.”

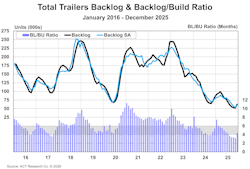

Bigger backlogs and a lower December build rate conspired to push the backlog-to-build ratio higher for the first time in 2025, McNealy added, indicating multiple challenges remain entering the new year.

“End-of-2025 challenges continue as the trailer industry enters the new year, and opportunities in early 2026 remain thin,” she concluded. “Positively, freight rates are now rising and the need to replace aging equipment continues to build. Pent-up replacements are expected to improve demand later this year.”

2025 trailer orders beat 2024

The December tally was up nearly 13,400 units from a month earlier, resulting in 172,100 trailers ordered in 2025—about 6% more than 2024.

“Sequentially, a slight uptick in net orders was expected, as December is usually the second strongest order month of the annual cycle,” McNealy explained. “That said, preliminary data showed new vehicle demand for power units jolt awake in December, and those same factors of a firmer economic foundation, December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are also in play for trailing equipment demand.

“December’s tally brings the Q4 net order total to 53,400 units and closes 2025 with 172,100 units of trailing equipment ordered—about 6% more trailers than were requested in 2024. While a better year than 2024, concerns about the level of economic activity that drives transportation demand, still-weak, although improving, for-hire carrier profitability, and uncertainty about future government policies remain as challenges to stronger trailer demand in the near term.”