Reports: Trailer order activity improves in October

Key Highlights

- U.S. trailer orders in October increased 77% m/m, according to FTR, but still lag 10-year averages, indicating cautious fleet investment.

- Order intake for October was 17,100 units, per ACT data, 3% above last October, with a year-to-date increase of 17% in net orders.

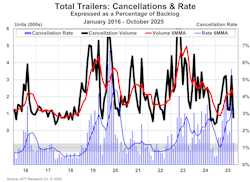

- Cancellations eased slightly to just above 5%, with the tank segment experiencing the highest cancellation rates due to declining oil and gas activity.

- Backlogs declined to 71,990 units, the lowest since mid-2020, suggesting reduced industry backlog and production alignment with demand.

U.S. trailer orders spiked in October, with FTR Intel and ACT Research both reporting significant month-over-month improvement from September.

FTR’s preliminary October tally checked in at 15,916 units, a 77% month-over-month increase that still was 5% below year-ago levels, the firm said. The sharp m/m rebound points to renewed fleet engagement—and fewer cancellations—but order volumes remain below the 10-year October average of 37,116 units as operators continue to grapple with soft freight demand, weak profitability, elevated input costs, and persistent uncertainty over trade policy and macroeconomic conditions.

Cancellations eased to just above 5%, suggesting some stabilization. However, many fleets remain cautious and are postponing 2026 commitments until market conditions and pricing visibility improve, FTR added. The modest year-over-year (y/y) decline underscores ordering behavior is still primarily replacement-driven with limited evidence of fleets adding growth capacity.

“The U.S. trailer market continues to experience meaningful pressure from volatile trade policy, elevated material costs, and weakening fleet sentiment,” Dan Moyer, FTR senior analyst for commercial vehicles, said in a news release. “Although a Supreme Court ruling could eliminate country-specific tariffs depending on the outcome, the main tariff cost for the trailer industry comes from the 50% Section 232 tariffs on steel, aluminum, and copper that will be unaffected.

“OEMs and suppliers are adjusting to higher costs and softer demand through selective price increases, tighter cost controls, and sourcing shifts. Fleets are extending equipment life cycles, prioritizing maintenance, and limiting new capital commitments as elevated costs and policy uncertainty continue to weigh on near-term trailer demand.”

October intake higher than expected, per ACT

Preliminary net trailer orders in October were 5,700 units higher than September’s 11,300 level in a 51% month-to-month increase, according to ACT’s data. At 17,100 units booked in October, order intake was 3% above last October’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to about 12,600 units.

“Sequentially, October’s higher net order intake was expected, as it is usually one of the strongest order months in the annual cycle initiated at the end of Q3 when the industry begins opening next year’s order boards,” said Jennifer McNealy, ACT director of CV market research and publications. “October’s tally brings the year-to-date net order total to 138,300 units, or 17% more net orders than were accepted through year-to-date October 2024.

“Looking forward, concern continues that moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous governmental policy, especially around the EPA low-NOx rule, remain as challenges to stronger trailer demand. However, pent-up demand is building, and fleets eventually will need to divert capex to trailing equipment purchases deferred over the past few years.”

Tank segment produces most cancellations

With the majority of 2025 in the rearview mirror, the U.S. trailer market remains in “stay afloat” mode, as fleets continue their wait-and-see strategy, according to ACT’s October State of the Industry: U.S. Trailers report.

“October’s trailer cancellation rate, as a percentage of backlog, was a more subdued 1.3% versus last month’s overstated 5.6%. Data continued to show elevated cancellations in reefer and tank segments,” McNealy said. “The largest level of cancels came from the tank segments, attributed to a decline in oil/gas activity, in general.

“With higher build rates, lower backlogs, and two more production days in October, the industry BL/BU ratio remained at 3.3 months for the second consecutive month. October’s build rate and the current backlog commit the industry into mid-Q1 2026. Overall, backlog remains at rock-bottom levels with the new year’s order boards opening.”

Cumulative orders for September and October combined are down 15% y/y to 24,917 units as multiple market headwinds weigh on fleet sentiment.

Trailer production edged slightly lower in October with builds down 2% m/m but 2% higher y/y at 17,527 units. Despite the modest pullback, many OEMs have continued building at relatively elevated rates—likely to preserve labor continuity, support fixed-cost absorption, draw down lingering component inventories ahead of year-end, or preempt potential tariff-related cost pressures, FTR added. Backlogs declined 2% m/m and 14% y/y to 71,990 units, keeping the backlog/build ratio steady at 4.1 months, its lowest point since mid-2020.

“With production still running ahead of demand, OEMs will need to meaningfully lower build rates soon unless the 2026 order season gains further traction,” FTR concluded.