Reports: Trailer orders fall amid uncertainty

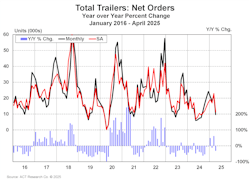

U.S. trailer order intake fell sharply in April amid growing headwinds, according to the newest data from ACT Research and FTR Intel.

In the May issue of its State of the Industry: U.S. Trailers report, ACT pegged the April tally at 9,400 units, down more than 57% from March and 32% lower than the subdued level of orders accepted in April 2024.

“April’s net order intake puts the year-to-date order tally at 70,500 units, 13% higher than the 62,200 bookings for the first four months of 2024,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release. “While appearing to be better news, we caution that the industry’s annual period of seasonally stronger order months has ended, and weaker intake months are expected from now through mid-Q3.

“After being stable in December and January, cancellations started to escalate, jumping in April to 2.3% of the backlog. Trailer production was more than 8,200 units higher than order placements in April. As a result, backlogs contracted 8% sequentially and remain sharply lower against 2024’s soft backdrop.”

FTR reported a higher number, with net orders of 10,669 trailers in April, but that’s still a sharp decline of 50% month-over-month and 23% year-over-year as substantial tariff volatility and increasing uncertainty over the economy and the truck freight market took their toll.

April’s monthly decline surpassed typical seasonal patterns by a wide margin, FTR added. Even so, U.S. trailer orders exceeded North America Class 8 net orders for a third straight month. And despite April’s substantial decrease, year-to-date (YTD) trailer net orders for 2025 totaled 76,901 units, representing a 27% increase compared to the same period last year.

Total trailer build in April decreased 1% m/m and 26% y/y to 17,619 units. 2025 YTD trailer build fell 30% y/y to 63,756 units, an average of 15,939 per month. With total trailer net orders well below production, backlogs decreased by 6,562 units (-5% m/m; -19% y/y) to 120,350 units. The larger m/m decrease in backlogs compared to build lowered the backlog/build ratio to 6.8 months.

“U.S. tariffs and potential retaliatory measures will significantly impact the U.S. trailer market, raising costs for imported materials and affecting domestic production,” said Dan Moyer, FTR senior analyst for commercial vehicles. “OEMs and suppliers can expect higher production costs, reduced margins, and potentially softer demand, prompting some potential shifts toward local sourcing or domestic manufacturing.

“Some fleets may delay new trailer purchases—reflected in the sharp decline in April net orders—and extend equipment lifecycles, boosting aftermarket activity. Rising costs might also encourage limited industry consolidation, creating acquisition opportunities for larger manufacturers.

“Trailer industry participants that proactively manage supply chain disruptions and pricing pressures may gain a competitive advantage.”