Trailer orders increased year-over-year in April, but orders in the first four months of 2024 were down compared to last year and trailer production declined year-over-year and month-over-month, according to the latest reports from industry analysts ACT Research and FTR Transportation Intelligence.

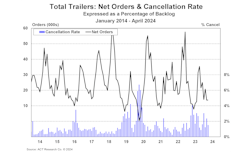

ACT pegged April’s order total at 13,700 units, which is up 21 year-over-year but only 100 trailers more than fleets ordered in March, bringing “first-trimester” net order activity to 62,100 units—22% lower than the period in 2023.

“Seasonally adjusted, April’s orders were 17,300 units compared to a 13,800 seasonally adjusted rate in March,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release. “On that basis, orders increased 25% month-over-month. Dry vans grew 41%, with reefers up 26%, but flats were 27% lower compared to April 2023.

“Total cancellations again oscillated to the lower but still-elevated side of the pendulum in April. The cancellation rate slipped to 1.5% of the backlog, from March’s 2.3% rate. Seven of 10 markets remained above the 1% mark, with OEMs indicating cancellations from multiple fleets and dealers.

“In this capex constrained environment, and with an expensive EPA mandate landing in 2027, fleet willingness to spend on trailers is under considerable pressure. Couple these factors with overstocked dealer inventories proving hard to move, a short-and-soft peak order season, and the absence of a need for carriers to boost trailer-to-tractor ratios, and it adds up to a challenging part of the cycle for the U.S. trailer industry.”

Those challenges depressed trailer production, with dropped 3% month-over-month to 22,975 units, FTR reported. Production was down 12% year-over-year, which aligns with the average April build level over the past five years.

FTR’s April order total came in at 13,016 units, a gain of 9% month-over-month that still left total orders 20% below the average for the last 12 months.

The firm also reported fleets now have ordered 199,000 units over the last year.

With trailer orders coming in below production levels, backlogs fell “somewhat” in April, shedding 5,060 units to end at slightly more than 147,000 units. The decrease in backlogs would have been about twice as large if not for an OEM revision of backlogs that resulted in a roughly 5,000-unit increase for dry van and total backlogs, FTR continued. With production and backlogs declining by a similar degree, there was no material change to the backlog-to-build ratio, which remains at 6.4 months.

This ratio, which is slightly below the average level for the last half of 2023 but above the historical average before 2020, currently indicates little overall incentive for trailer manufacturers to adjust production levels.

“With the truck freight market facing challenges, solid growth in April for both total van and major vocational trailer orders offers a few green shoots of optimism,” said Dan Moyer, FTR senior analyst for commercial vehicles. “Unless this growth continues in the coming quarters, decreasing backlogs and high dealer trailer inventory levels will put further downward pressure on trailer build rates.”