January trailer orders continue ‘softening trend’

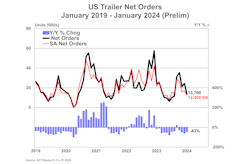

Trailer manufacturers logged fewer orders in January than in the same month last year, according to preliminary reports from two transportation analysts.

FTR Transportation Intelligence reported a 38% drop from January 2023, with fleets ordering 15,518 units, and ACT Research observed a 43% year-over-year dip to 13,700 units. Both firms reported orders fell from December as well.

“With the pent-up demand enjoyed by the industry during the past few years largely extinguished, a softer opening to 2024 meets expectations,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release.

“Net orders are being challenged by a backdrop of weak profitability for for-hire truckers, and anecdotal commentary from trailer manufacturers throughout the past several months have been indicating this slowing, as they have shared that orders are coming but not at the same rapid pace that they have the last few years.”

ACT’s seasonally adjusted January tally is slightly lower at 12,400 units.

“This month’s results continue to support our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted,” McNealy said. “That said, the lower orders don’t indicate a catastrophic year in the offing, simply one that is on target to be less stellar than we’ve seen recently.

“Another indicator being watched closely is cancellations, which oscillated above comfortable levels for most segments in January. While the industry’s largest segments are under pressure, some specialty segments have no available build slots until late in 2024 at the earliest, while others are in the three-month range.”

Total trailer orders in January were 23% below the 2023 average, and trailer orders over the last 12 months decreased to 233,600 units, FTR added.

Additionally, trailer production eased by 2% in January to 19,680 units, FTR reported. Production was down 22% year-over-year. That build number is the lowest since January 2023 and marks a fifth straight month of declines dating to August 2023.

With orders coming in below production levels, backlogs in January fell “somewhat,” shedding more than 4,000 units to end at over 139,200 units, FTR concluded.

“The relatively similar fall in both production and backlogs resulted in no material change to the backlog-to-build ratio, which stands at 7.1 months,” said Eric Starks, FTR chairman of the board. “This ratio is slightly elevated due to lower production levels and is above the historical average prior to 2020. A jump in the ratio is normal around the holiday season, and the overall picture is still of an industry that is continuing its move toward a pre-pandemic level of stability.”