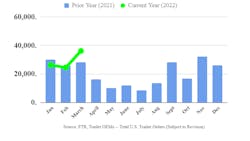

Trailer OEMs opened their order books in a big way in March.

FTR Intel and ACT Research both reported the industry's highest order totals since December 2020, with FTR pegging the preliminary tally at 36,200 units and ACT coming in at 37,900 trailers.

FTR’s number represents a 41% month-over-month increase, and 29% year-over-year uptick. Most of the major OEMs registered “sturdy numbers,” according to FTR, showing significant increases vs. the past six months. March’s strong order total is expected to raise backlogs above the 200,000-unit mark for the first time since May 2021.

Trailer orders for the past 12 months now total 252,000 units, FTR added.

“This is great news for the trailer market,” said Don Ake, FTR vice president of commercial vehicles. “Most of the big OEMs were stuck in a holding pattern on orders since the supply chain tightened. The fact they have the confidence now to enter more orders may indicate that supplier deliveries are showing improvement, and labor shortages are abating.

“It is uncertain if this level of orders can be sustained. However, it does signal an expectation that build rates could increase later this year. Because OEMs had their output limited by the supply chain, we estimate that pent-up demand for trailers could be as high as 100,000 units. It will take an extended time for OEMs to catch up with fleet requirements once the supply chain opens up.”

ACT’s preliminary report indicates order totals in March rose 40% month-over-month and 28% year-over-year.

“Our discussions this month revealed a variation in order acceptance strategies across the industry. Some OEMs noted that their extremely low order volume was the result of a ‘sell-out’ of their projected available production slots for the remainder of the year,” said Frank Maly, director commercial vehicle transportation analysis and research at ACT. “Others, accepting higher order volumes, were in the process of filling their remaining production capacity for 2022.

“Also mentioned was an unwillingness to officially open 2023 orderboards, with concerns about setting pricing the major challenge. A positive development was indication that some supply-chain relief was beginning to be felt. Final figures for the month will likely reveal total industry backlog now stretching into December at current production rates, heavily influenced by dry van and reefer commitments that basically fill their year.”