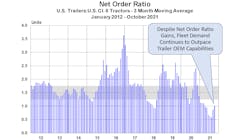

October net U.S. trailer orders of 17,405 units fell more than 38% from the previous month and were nearly 69% lower compared to October of 2020, ACT Research said.

Before accounting for cancellations, new orders of 19,600 units were down almost 40% vs. September, and 66% lower than the previous October, according to November’s issue of ACT’s State of the Industry: U.S. Trailer Report. YTD net orders and new orders for the first 10 months of 2021 were both about 10% lower compared to the same time period in 2020, which included the COVID-stricken spring data.

“October net orders were down sequentially and year-over-year, against last October’s very tough comparison, the second-highest net order month in industry history when fleet investment plans rebounded from the spring COVID doldrums,” said Frank Maly, director of commercial vehicle transportation analysis and research at ACT. “The major impact on October data came from the dry van category, where, after a cautious bit of quarter-ending order acceptance, OEMs became much more careful about extending the orderboard horizon excessively. Reefers posted a very solid month-over-month increase in net orders.

“While net reefer orders in October are still well below normal industry volume, they outpaced the total for the entire third quarter. Expect order acceptance to be closely managed for the foreseeable future, with OEM challenges including the current strong backlogs that commit many of them for a major portion of next year and their inability to ramp production volume in response to surging fleet demand.”

ACT’s U.S. Trailers report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.