Survey shows carriers’ response to ELDs

Transplace, a provider of transportation management services and logistics technology, announced the results of its Electronic Logging Device (ELD) survey conducted to gain insight into implementation preparedness and expected impact for transportation carriers.

The survey, which included more than 400 carriers, identified that responses to ELD implementation and expected impact to capacity and utilization varied greatly by fleet size.

“While created to improve safety within the transportation industry, the Federal Motor Carrier Safety Administration’s ELD mandate has left shippers and carriers with a lot of questions: how will this impact driver productivity; will drivers leave the industry as a result; will smaller carriers close up and leave the industry,” said Frank McGuigan, president and chief operating officer, Transplace.

Key observations from the ELD survey include:

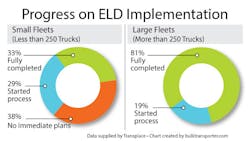

• ELD implementation varied greatly by fleet size—The study revealed a significant difference in the amount of implemented ELDs between large and small fleets. Eighty-one percent of large fleets (more than 250 trucks) reported that they had achieved full ELD implementation, with the remaining 19% working toward implementation. Conversely, small fleets (less than 250 trucks) have been much slower to integrate ELDs, with only 33% having fully integrated ELDs into their fleet. Another 29% have begun the implementation process, while the remaining 38% have no immediate plans to begin implementation.

• Capacity and utilization expected to change, but the amount varies—While most carriers expect their capacity or utilization to be affected as a result of ELDs, 56% of large fleets expect their utilization to decrease while 32% expect to see no impact from their implementation. Smaller fleets are even more cautious about how their utilization will be affected, with 64% expecting a decrease and 25% expecting no change.

• Drivers have already left the industry as a result of ELDs—As expected, ELDs have caused drivers to exit the industry. In fact, 51% of carriers indicated that they have lost drivers who did not want to operate under ELDs. While most indicated that they only lost a few drivers, one carrier reported losing 50% of its drivers.

• ELDs will have a significant financial impact—While all carriers surveyed expect a financial impact as a result, the average financial impact per unit varies: $100-$300 (18%); $300-$500 (19%); $500-$700 (18%); and more than $700 (45%).

• ELDs have led to a reduction in HOS and logging violations—Of those carriers that have implemented ELDs, 84% of large fleets and 56% of smaller fleets reported a reduction in hours-of-service (HOS) and logging violations.

• ELDs will have some business benefits—While the anticipated impact on the industry has been generally negative, carriers do foresee some benefits as a result of ELD utilization within their companies, including: improved monitoring (33%); better driver and equipment utilization (21%); driver convenience (10%); reduced operating costs (2%); fuel savings (2%); and other (32%).

To learn more, see http://go.transplace.com/ELD_LP. ♦