Industry research groups reported record Class 8 orders for 2023 during September, a month in which they are typically among the highest, but orders still lagged significantly year-over-year.

Preliminary Class 8 net orders in North America came in at 36,800 units for the month of September—up 67% from August. These numbers place September as the strongest order month this year, according to ACT Research.

FTR Transportation Intelligence reported a slightly smaller number of units ordered at 31,200—an increase of 94% from what the agency reported in August and a decrease of 45% from last September.

FTR’s chairman of the board, Eric Starks, said the team expected an increase in orders with the opening of build slots for 2024 production, and fleets are placing those orders at a “solid pace.” These order numbers also indicate the market is continuing to normalize after last year’s “exceptional” order volumes, according to the report.

“We saw increases across the board versus August—another indication that this is a broad-based gain for the market,” Starks said. “Despite the weakness in the overall freight market, fleets continue to be willing to order new equipment. We did not anticipate matching the level of orders that we saw this time last year, but increasing orders confirm our expectations of replacement demand in 2024.”

ACT’s president and senior analyst, Kenny Vieth, said his team wasn’t sure what to expect when build slots opened, but “one thing we did know was that nearly all the August-ending Class 8 backlog was scheduled for build in 2023,” he said. “So strong orders are imperative for the industry to maintain current strong production rates very far into 2024.”

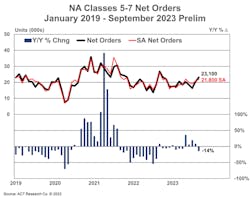

ACT Research also released preliminary numbers on Class 5-7 net orders, which were “more trend-like” at 23,100 units, rising 13% compared to August. ACT will provide final numbers when it releases its monthly “State of the Industry: Classes 5-8 Vehicles” report. The report will also detail sales, current production, and general state of the on-road heavy- and medium-duty commercial vehicles in North America.

“While it is too early to infer much from September orders, data from the OEMs confirm the ‘season’ started on the right foot,” Vieth said.

This story originally appeared on FleetOwner.com.